ARTÍCULOS ORIGINALES

DOI: 10.17230/ad-minister.28.1

Disaster Risk Management In Business Education: Setting The Tone

Gestión De Riesgo De Desastres En La Educación De Negocios: Marcando Las Pautas

JUAN PABLO SARMIENTO1

1 Director of the Disaster Risk Reduction Program, funded by the U. S. Agency for International Development

and housed in the Florida International University Extreme Events Institute. Research Professor

at the Department of Health Policy and Management in the Robert Stempel College of Public

Health and Social Work, Florida International University, United States. Email: jsarmien@fiu.edu

Received: 18/03/2016 Modified: 03/06/2016 Accepted:10/06/2016

ABSTRACT

Looking for windows of opportunity to mainstream disaster risk management within business education,

in 2015, the United Nations Office for Disaster Reduction's (UNISDR) Private Sector Alliance for Disaster

Resilient Societies (ARISE), partnered with Florida International University's Extreme Events Institute

(FIU-EEI) and 12 international leading business schools. This partnership began with a call for White

Papers to propose innovative approaches to integrate cutting edge disaster management content into

business education programs and other academic offerings, based on seven themes or niches identified:

(1) Strategic Investment and Financial Decisions; (2) Generating Business Value; (3) Sustainable Management;

(4) Business Ethics and Social Responsibility; (5) Business Continuity Planning; (6) Disaster Risk

Metrics; and (7) Risk Transfer. In March 2016, an international workshop was held in Toronto, Canada to

present the White Papers prepared by the business schools, and discuss the most appropriate approaches

for addressing the areas of: teaching and curriculum; professional development and extension

programs; internships and placement; research opportunities; and partnerships and collaboration. Finally,

the group proposed goals for advancing the implementation phase of the business education initiatives,

and to propose mechanisms for monitoring and follow-up.

KEYWORDS Business continuity; business education; business ethics; business value; disaster risk; disaster risk

metrics; financial decisions; risk transfer; SMEs; social responsibility; and strategic investment.

RESUMEN

En la búsqueda de ventanas de oportunidad para incorporar la gestión del riesgo de desastres en la

educación de negocios, en el año 2015, la Alianza del Sector Privado para Inversiones Sensibles al

Riesgo (ARISE) de la Oficina para la Reducción de Desastres de las Naciones Unidas (UNISDR), en

asocio con el Instituto de Eventos Extremos de la Florida International University Florida International

University (FIU-EEI) y 12 importantes escuelas internacionales de negocios. Esta alianza comenzó con

una convocatoria de libro blancos (White Papers) para proponer enfoques innovadores para integrar

contenido de vanguardia de gestión del riesgo de desastres a los programas de educación de negocios

y demás ofertas académicas, basadas en siete temas o nichos identificados: (1) Inversión Estratégica

y Decisiones Financieras; (2) Generación de Valor de Negocio; (3) Gestión Sostenible; (4) Ética en los

Negocios y Responsabilidad Social; (5) Planeación de la Continuidad de Negocio; (6) Métricas del Riesgo de Desastre; y (7) Transferencia de Riesgo. En marzo de 2016, se realizó un taller internacional en Toronto, Canadá

para la presentación de los libros blancos preparados por las escuelas de negocios, y discutir los enfoques

más apropiados para abordar áreas de: enseñanza y currículo; desarrollo profesional y extensión de programas;

pasantías y colocaciones; oportunidades de investigación; y alianzas y colaboraciones. Finalmente, el grupo

propuso metas para avanzar en la fase de implementación de las iniciativas de las escuelas de negocios y para

proponer mecanismos para su monitoreo y seguimiento.

PALABRAS CLAVE Continuidad de negocio; educación de negocios; ética en los negocios; valor de negocio; riesgo de desastre;

métrica de riesgo de desastres; decisiones financieras; transferencia de riesgo; PYME; responsabilidad social e

inversión estratégica.

BACKGROUND

At the end of 2013, Florida International University's Extreme Events Institute (FIU - EEI) joined what is today the United Nations Oftce for Disaster Reduction's (UNIS - DR) Private Alliance for Disaster Resilient Societies (ARISE), where FIU is leading the Activity Stream #4: State-of-the-Art Disaster Risk Management, Education, Training, and Outreach. In 2015, UNISDR and ARISE, with support from the Federal Government of Germany's Ministry for Economic Cooperation and Development (BMZ), partnered with FIU-EEI and 12 leading business schools to improve or introduce disaster risk management into the curricula of higher education and training services. This supports Priorities for Action I, III, and IV, as stated in the Sendai Framework for Disaster Risk Reduction 2015-30.

This partnership with leading business schools worldwide began with a call for White Papers that propose innovative approaches to mainstreaming cutting edge disaster management content into business education programs and other academic offerings. A list of the selected White Papers is provided in Annex 1.

The project also sought to develop training and outreach programs for small and medium enterprises, which may struggle to gain access to information, by engaging the support of larger experienced corporations, particularly those working in public-private partnerships.

In March 2016, an international workshop was held in Toronto, Canada to present the White Papers prepared by the business schools; discuss the most appropriate approaches for revising existing curricula; and propose new disaster risk management (DRM) courses for existing undergraduate, graduate, professional development, and extension programs. A jury was convened among the sponsor agencies (UNISDR and FIU) to select the best paper in each of the two categories of existing and new DRM academic offerings from the White Papers received. The awards went to: (1) The Rotman School of Management, University of Toronto (Existing DRM academic offering); and (2) The Mona School of Business & Management, University of the West Indies (New DRM academic program). Each laureate university received a prize of USD 10,000 for the implementation of the proposal submitted.

With the support of EAFIT's Business School and the Editorial Committee of AD-minister, we conducted a blind peer review of the White Papers and are publishing a special issue of Ad-minister dedicated to Disaster Risk Management & Business Education: Sustainable and Resilient. The objective of the special issue is to disseminate current advances in DRM as it relates to business education. This publication is supported by Florida International University's Disaster Risk Reduction in the Americas Program, under a Cooperative Agreement with the United States Agency for International Development's Oftce of U.S. Foreign Disaster Assistance (USAID/OFDA).

This chapter sets the tone for the conversations around DRM and presents the findings of the discussion groups at the Toronto meeting. Five important topics were discussed: teaching and curriculum; professional development and extension programs; internships and placement; research opportunities; and partnerships and collaboration. The final section lists the proposed goals for advancing the integration of disaster risk management to the business curriculum.

EXPLORING A NICHE

Multiple attempts were made to reach out to the business education community, looking for windows of opportunity to embrace the topic of DRM within their academic and extension programs. After careful examination, seven themes related to innovative approaches and cutting edge DRM content were identified: (1) Strategic Investment and Financial Decisions; (2) Generating Business Value; (3) Sustainable Management; (4) Business Ethics and Social Responsibility; (5) Business Continuity Planning; (6) Disaster Risk Metrics; and (7) Risk Transfer.

Strategic Investment and Financial Decisions, or strategic financial management, combines financial management with corporate strategy. Strategic financial management focuses on the creation of value through effective management of a company's financial resources to develop goal-directed actions in order to gain and sustain superior performance relative to its competitors. While both types of financial management, corporate and strategic, seek to maximize value for share- holders and stakeholders, the main distinction between traditional corporate financial management and strategic financial management is the latter's commitment to the long-term strategic goals of the company. There are different schools of thought regarding the combining of strategic and financial management. Traditional financial managers strive to maximize value for stakeholders by allocating resources into investments that generate the most cash return. However, some scholars stress that current capital budgeting techniques alone may not be the most suitable tools for financial managers who seek to achieve strategic goals. This is because financial analysis, on its own, may sacrifice the long-term health of a company for short-term financial gains, creating a bias against long-lived, capital-intensive projects that would add substantial competitive advantage to a company in the long run. They argue that the market value of a company is not only described by its capacity to generate cash flow through its assets, but should also reflect the firm's strategic growth potential. This means that the value of the firm would also derive from its capacity to undertake future investment opportunities in a scenario sensitive to competitive moves.

Generating Business Value. The generation of business value, or in other words, the creation of value by the company in order to create and/or satisfy customer demands, is considered the most important activity a company or organization performs. The exact definition of 'value' has varied significantly over time, from the large-scale industrial processes that based their value-added processes on the transformation of raw materials into manufactured goods, to modern processes, where knowledge and information demand focus, and the main purpose of a business is to identify, capture and deliver value for its stakeholders. The process of business value generation begins with a value proposition, a description of the benefits customers perceive and expect from a company's products and services. It is important to note that the customers' perception of value may stem from a variety of characteristics of a company's products/services, ranging from physical attributes, quality of services, price, performance or other features. This fact highlights both the tangible and intangible nature of the concept of value. Early literature on value creation sought to distinguish value (singular) from values (plural). The former implies preferential judgment, while the latter was described as a set of principles that substantiate the judgments made. Generally, current literature on generating business value shares the thinking that 'value' is connected to the idea of 'trade-off.'

Sustainable Management. The concept of sustainable management has stemmed from ongoing discussion about the role of businesses in society. Scholars widely agree that corporations play a central role in the ecological future of the globalized world, where governments' ability to act is often limited by international agreements. Corporations are the heart of modern economies. They have a direct impact on our biosphere, due to their use of natural resources; the pollution generated from production practices; and the promotion of patterns of consumption. For these reasons, in the years following the 1992 Earth Summit in Rio de Janeiro, organizations tackled environmental challenges, positioning themselves as pro-sustainable development and introducing environmental action plans and joint action programs. The general idea of sustainable management is to combine notions of sustainability with management theory in order to allow organizations to run eftciently without depleting natural resources and to satisfy current demands without harming future generations' development. Scholars have identified three main reasons for organizations to adopt sustainable management practices: competitiveness, legitimation, and ecological responsibility. The two leading process models for Sustainable Management are Stuart Hart and Amory B. Lovins et al.

Business Ethics and Social Responsibility. The study of business ethics and social responsibility aims to define a corporation's business policies and practices in the marketplace and also in society. The discussion about ethics in business was a spill- over from the dominant approach to the moral dimension of business, which came to be known as corporate social responsibility. This perspective sought to create a new managerial discipline that later came to be known as business ethics. It was believed that bringing experts in moral philosophy into business schools would generate analytical frameworks and conceptual tools that managers needed in order to choose the morally correct course in diftcult ethical situations. However, scholars have emphasized that disagreements exist with regard to the exact meaning of business ethics. Some scholars have pointed out that the concept of business ethics does not exist since corporations are not persons and therefore cannot be held morally responsible for their actions. Scholars argue that the literature on business ethics can be divided into two distinct and broad categories: normative literature and positive literature. Normative literature seeks to provide managers with the concept of what they 'ought to do' and presents useful models that managers can apply to make decisions on situations that have an ethical dimension. Positive literature surveys the opinions of groups of people in order to assess what they consider to be ethical or unethical.

Business Continuity Planning (BCP). BCP intends to identify all the processes, protocols, assets, and benchmarks required for an organization to develop plans that ensure the safety of its employees, its community and the continuity of time-sensitive operations. Since unforeseen events can disrupt business operations and cause revenue losses, a business continuity plan for the resumption of normal operations is essential, not only for the survival of the company, but also for the recovery of the region in which the business operates. Scholars argue that business continuity planning originated in the 1970s, with the emergence of mainframes and networking technology and the subsequent need to secure data from unpredictable events. Nowadays, BCP has evolved together with business models, expanding its focus from technology infrastructure to all the processes and management procedures involved in the continuation of the business in its entirety. Scholars emphasize that business continuity plans should not focus on a particular type of event that may disrupt a company's operations. Instead, it is more important to design a broader plan that encompasses all the steps necessary for an organization to carry on its operations. The idea is that reducing down-time accelerates restoration and recovery of businesses after unforeseen events disrupt their critical operations.

Disaster Risk Metrics. Measuring disaster risk is a complex activity because natural or manmade disasters involve different dimensions and stakeholders. Consequently, risk may be perceived differently. Generally, risk is expressed in terms of loss of life and financial resources. In addition to the lack of common ground on the matter, the

variables involved in calculating disaster risk are not easily quantifiable and may involve several different scientific methods. Since risks vary considerably, some cannot be compared using the same scale. The discipline of disaster risk metrics emerged from the need to create multi-hazard risk metrics, based on scientific methods and evidence, in order to better bridge the gap from insurance models and to better inform disaster risk reduction policies. In the early 1990s, the insurance industry was severely impacted by the challenge of accurately measuring disaster risk and putting a price on insurance. Their model was based on losses from over several decades in a particular region and were proved insuftcient to determine the true average cost of large catastrophes. Nowadays, the metrics commonly used to quantify social and economic impacts derived from disasters may include several different variables.

Risk Transfer. According to the United Nations Oftce for Disaster Risk Reduction (UNISDR), risk transfer is the ''process of formally or informally shifting the financial consequences of particular risks from one party to another whereby a household, community, enterprise or state authority will obtain resources from the other party after a disaster occurs, in exchange for ongoing or compensatory social or financial benefits provided to that other party.'' The most common form of risk transfer is insurance, where the insured person pays ongoing premiums in exchange for coverage of pre-determined risk and/or events. Often different stakeholders, such as governments, insurers, multilateral banks and other large risk-bearing entities establish mechanisms to help cope with losses in major events. The most common mechanisms put into place before extreme events are insurance and reinsurance contracts, catastrophe bonds, contingent credit facilities and reserve funds, where the costs are covered by premiums, investor contributions, interest rates and past savings, respectively. These initiatives are deemed crucial since they provide much needed, immediate liquidity after a disaster for more effective government response, and some relief of the fiscal burden placed on governments by spreading the costs of recovery among different stakeholders. However, some scholars argue that these formal mechanisms do not satisfactorily address the issue of reaching the poor, who are consistently the most affected by disasters.

OBJECTIVES OF THE TORONTO WORKSHOP

- Present and discuss the White Papers on DRM in Business Education and the vision of convening universities, business schools and MBA programs.

- Discuss options for mainstreaming DRM within the curricula of undergraduate and graduate studies, as well as outreach and professional development programs.

- Explore partnerships and agreements to move toward an implementation phase.

- Propose mechanisms for follow-up and monitoring.

PARTICIPATING INSTITUTIONS

Brazil Fundação Getulio Vargas, Escola de Administração de Empresas de São Paulo (FGV-EAESP)

Canada Concordia University, John Molson School of Business

Canada York University, School of Administrative Studies

Canada University of Toronto Rotman School of Management

Chile University of Chile

Colombia Universidad EAFIT

India Indian Institute of Management, Bangalore

Jamaica University of the West Indies, Mona School of Business and Management

Mexico Monterrey Institute of Technology and Higher Education, School of Business

Peru ESAN University, Graduate School of Business

Indonesia University of Gadjah Mada, Faculty of Economics and Business

United States Florida International University, Small Business Development Center (SBDC) and the and the Extreme Events Institute (EEI)

PARTNER AGENCIES

The United Nations Oftce for Disaster Risk Reduction (UNISDR) supports the implementation of the Sendai Framework for Disaster Risk Reduction 2015-2030. The Sendai Framework was adopted at the Third United Nations World Conference on Disaster, the achievement of its seven global targets by 2030. The Framework highlights a lack of regulation and incentives for private disaster risk reduction investment as an underlying risk driver, and calls for business to integrate disaster risk into their management practices.

ARISE is the Private Alliance for Disaster Resilient Societies, an initiative of the UNISDR.

Florida International University's Extreme Events Institute carried out this event, in close cooperation with appropriate universities and institutes across the globe and special support from York University (Canada).

Financial support for these discussion was provided by the Federal Government of Germany's Ministry for Economic Cooperation and Development (BMZ).

DISCUSSION TOPICS

The five themes selected for the group discussions: (1) Teaching opportunities and curricula development; (2) Professional development and extension programs; (3) Internships and placements; (4) Research opportunities; (5) Partnerships and collaborations. Then, participants worked on the follow-up aspects to move toward an implementation phase and to propose mechanisms for monitoring.

Discussion Topic 1. Teaching and Curriculum Development

Moderator: John Molson School of Business – Concordia University

Discussions surrounding teaching opportunities and the development of curricula for disaster risk management (DRM) focused on four main themes:

- Integrating DRM into the curriculum;

- Making the case for a DRM curriculum;

- Addressing the lack of teaching resources and materials;

- Desired educational outcomes.

Below we describe the challenges, opportunities and recommendations made with regard to each of these themes.

Integrating Disaster Risk Management into the Curriculum

Integrating DRM into the business education curriculum can occur at several levels:

- Integration into existing core courses;

- Development of new elective courses;

- Creation of new DRM programs and degrees.

Several key points for consideration were put forth with regard to integrating DRM into the curriculum.

- DRM can face competition from other topics.

- Business continuity and sustainability courses may present the best opportunities for integrating DRM topics.

- Begin on a smaller scale with lectures, guest lecturers, articles, case studies, course units/modules, special events, etc. and scale up over time to create full courses and programs.

In order to maximize the opportunities to integrate DRM into the curriculum, the following recommendations were made:

- Refrain from isolating DRM from similar topics such as strategic decision-making, risk management, and crisis management, as these topics complement each other.

- DRM courses could be developed according to niche expertise available at some universities.

- Create a recognized professional certification program, similar to Chartered Financial Analyst (CFA) or Financial Risk Management (FRM), which establishes best practices in DRM. Take into account the following issues:

- Proposed DRM certification may overlap with existing professional certifications.

- Many government certifications (especially at municipal level) are already available.

- An insuftcient demand for DRM certification in the overall job market may lead to considering the integration of DRM into existing professional certifications, such as those for risk management or business continuity.

- Establish a professional DRM association that requires periodic continuing education training to renew certification.

Making the Case for a Disaster Risk Management Curriculum

Institutional bureaucracy is a significant barrier to creating new teaching opportunities and developing appropriate curricula. Efforts to integrate DRM into the business curriculum may face resistance on many fronts and will require interest and commitment on the part of students, faculty, university administrators, and other stakeholders. The following challenges and opportunities were cited:

- Work to change the belief that DRM is a fleeting trend rather than a long-term paradigm shift. Dispel the myth that DRM is the government's responsibility and not relevant to businesses. DRM education should make a clear connection between the needs of government and businesses.

- Convince businesses that disaster risks are material to their fiscal wellbeing and that DRM must be part of their risk management strategy.

- Take advantage of the momentum building around climate change policies and practices—increased awareness, regulation, and stakeholder pressure—to integrate DRM into climate change adaptation efforts or as a complementary topic.

- Interest on the part of students is inherently tied to business interests and consequently will remain low as long as businesses and recruiters do not value DRM expertise. It will be necessary to identify gaps that need to be filled so that both companies and students see the value of DRM curricula and expertise.

- There needs to be a clear connection between real job descriptions and DRM educational content so that students see the value of taking such courses or programs.

Addressing the Lack of Teaching Resources and Materials

The lack of evidence-based resources and instructional materials presents a challenge for educators, which may be addressed by creating (individually or jointly) and sharing resources and materials. Following are opportunities and recommendations to increase the relevance of DRM to business education.

- Creating Resources

- Educators and experts will need to create new teaching materials such as textbooks, cases studies, and course outlines. The Sendai Framework for Action can serve as a guide.

- New materials should be designed to make it easy for the 'non-committed' to integrate DRM into existing courses and/or use it as a basis for new courses.

- Other venues for the use of new teaching materials include summer school programs, international programs, and MOOCs (massive open online courses).

- DRM teaching materials call for new business case studies, which could be used to promote a DRM case competition.

- Partnerships with expert organizations, such as the Red Cross, could also be fruitful in producing teaching materials and resources.

- Sharing Resources

- Sharing resources (cases, experiences, teaching material, course syllabi, research, niche areas of expertise, etc.) facilitates curriculum development and expands DRM education to a greater number of universities.

- It fosters standardization, best practices, and a common vocabulary among DRM educators and (future) practitioners.

- Meetings, conferences, and the creation of a formal or informal association of business schools could contribute to a meaningful dialogue among educators.

- The creation of a dedicated accessible/open/shared website would provide a venue for compiling resources for DRM curricula and facilitate partnerships.

- Alternatively, existing websites may be willing to host DRM resources. For example, the FEMA website (www.fema.gov/) for higher education already posts syllabi, yet not very many are in a business context. Prevention Web (http://www.preventionweb.net/english/) has a repository of documents, including training material, literature, academic and technical research. Prevention Web could easily adapt the site to provide a space for universities to share resources and materials. Awareness of the existence of the website is key.

- Adapting DRM to Business Education

- To make DRM relevant to business education, classroom learning can be combined with 'real' experience outside the classroom by encouraging students to work with companies on actual business issues.

- Small businesses appear to be especially overlooked and it may be necessary to advocate for research on the impact of disaster risk on small businesses.

- Existing DRM materials and resources can be adapted to relevant business education stakeholders. DRM materials can be adapted for small or large firms or to the challenges faced by a particular university, based on its location. Examples from universities leading in DRM business education will be valuable.

- A clear link between DRM and tangible business gains and losses must be shown, demonstrating that investing in resilience makes good business sense. This type of linkage is already being used with regard to sustainability and long-term planning in business curricula. DRM can be introduced into other business topics including strategic decision-making, economic performance, and business opportunities.

Desired Educational Outcomes

- Curriculum development will ultimately hinge on the goals of DRM business education. Disaster risk management curricula should not only raise awareness of the issues, but also equip students with the right expertise and skill sets to become disaster risk managers.

- DRM teaching materials should prepare students to practically implement disaster risk management. This will require consensus on the basic content, common vocabulary, definitions and standards, and best practices.

Conclusion

- Each university must adapt the strategies discussed to its own particular needs and realities. It is important to retain flexibility and offer different options according to the level of change possible in each institution, while ensuring that the Sendai Framework and the needs of students and business schools serve as the basis for DRM curriculum development.

- This requires clarifying educational goals and agreeing on DRM content that is universal, standardized, easy to share, and can be adapted to each university's needs. It also requires creating sharable resources and identifying existing international initiatives to build partnerships with key players.

Discussion Topic 2. Professional Development and Extension Programs

Moderators: Indian Institute of Management Bangalore & Faculty of Economics and Business – University of Gadjah Mada

The discussion of this topic focused on the following issues:

- How to promote professional development and extension programs in disaster risk management as it relates to businesses.

- The key challenges that must be examined both from a demandand a supply-side perspective.

- How to generate demand for professionals in the field of disaster risk management.

- How to make businesses recognize the need for DRM rather than having experts urge businesses to adopt DRM.

- How to reach small and medium enterprises (SME) so that DRM concepts are adopted more quickly.

Demand-side Measures

- Invest in creating greater awareness among businesses and professional associations on DRM issues by hiring professors/lecturers in the field; redesigning curricula; developing new (separate) DRM programs; creating executive education programs; etc.

- Explore creating a professional association to address requirements for mandatory certification and continuing education. Possibilities for areas of certification include business continuity; financial risk management; disaster recovery; etc. Business schools could provide training for existing professional designations.

- Certification training programs not only should address concepts related to DRM but also focus on solving real business problems.

- Invest in research on particular topics of interest to the business community (private and public sector) to identify needs, strategies, and appropriate technical assistance.

Supply-side Initiatives

- Create executive-level programs: non-degree programs for industry executives.

- Certification training programs for consultants should present both evidence-based knowledge as well as experiential learning that highlights best practices from industry.

- Use alumni networks of participating educational institutions and existing DRM and allied programs to promote internship opportunities as well as to seek support and collaboration for applied research on issues of importance to these organizations.

- Use alumni networks and school-industry linkages to reach SMEs.

Opportunities

- Many countries and specific sectors need professionals specialized in disaster risk management. There are significant opportunities for both academics and professional organizations, including consultants.

- Opportunities may be greatest in micro, and small and medium-size enterprises, which traditionally do not have the means to establish disaster risk management programs on their own, thus offering an opportunity to build capacity.

- Some associations or organizations are more stringent when it comes to requiring members to hold DRM certification. For example, in Indonesia, the Financial Service Authority requires that all bank management staff have risk management certification issued by the Indonesian Bankers Association (IBI). Other companies are required to hold ISO31000 or COSO if they choose to be vendors.

- Students in the University of Gadjah Mada's executive MBA program were required by the company sponsoring their studies to write their thesis on a disaster risk management problem or issue that the company had faced, a clear indication that many companies are giving growing importance to the topic.

- Universities and business schools have vast alumni networks and organizational ties that can be tapped into to create internship programs and conduct applied research.

Challenges

- The first challenge is managing the supply-side initiatives in a manner that builds credibility in the field of disaster risk management.

- Many small and medium-size enterprises operate in the informal sector and therefore may be diftcult to reach.

- The number of professionals (including professors/lecturers) working in disaster risk management is still limited and the field itself is not seen as offering a solid career path.

- Some professionals view certification as simply a means to improve their career path rather than using it as an opportunity to aggressively push for the adoption of DRM in their company.

Conclusions and Recommendations

- As noted above, creating demand and managing the supply of highly qualified and industry-ready DRM professionals is a major concern. This requires concerted and collaborative action by academic institutions, industry associations and policy makers.

- Raising awareness on the part of companies, public institutions, and individuals is the key to increasing the number of DRM professionals and the disaster resilience of companies.

- The opportunities/initiatives cited in this field are within our reach and challenges will most likely be overcome or reduced once initiatives are implemented.

Discussion Topic 3. Internships and Placement

Moderators: School of Administrative Studies – York University & University of Chile

General Observations

- Through internships and placements, the private sector can provide opportunities for students and professionals to build upon and improve disaster management and managerial skills.

- Internships and placements—such as the academic exchange of scholars, PhD candidates and post-doctoral positions—can create research development opportunities.

- They support a cross-fertilization of ideas from a more regional-global perspective on topics related to disaster risk management in business, rather than from a narrower, country-specific perspective.

- As interns or researchers work with public institutions, companies, the economic sector in general, or others to address disasters risks, they will also put their knowledge into practice to develop innovative solutions to stakeholders' challenges.

- With regard to internships and placements, both businesses and business schools should explore the options that work best for them, considering aspects such as course development; roles and responsibilities of different stakeholders; paid versus unpaid internships; field placements, and monitoring and supervision.

Opportunities

- Students, universities, and public and private organizations are interested in this issue. Students appreciate the importance of real world experience. Businesses and organizations are interested in receiving help and fresh ideas on DRR and business continuity, while helping students to learn in practice. Universities are allocating greater resources for experiential learning.

- Look to local opportunities and global possibilities. Although local economies have specific challenges related to natural disasters, there is a growing synergy between global networks of universities and global bodies, such as UNISDR and ARISE, which may be enlisted to share innovative methods to address local challenges.

- Alumni are a strong asset for universities and colleges when it comes to placements and internships. As York University's experience has shown, the extension and growth of a network of firms offering internships was strengthened, thanks to alumni and the positive experiences their firms witnessed.

Challenges

- Bureaucracy can be a major challenge. Compared to regular university courses, creating and implementing field placement and internship courses is very challenging and requires dedicated faculty, university resources, and interested local and national businesses. It also involves multiple levels of paperwork on both sides.

- Field placement and internship courses may require insurance coverage that can be provided by the government, university or host organization. Governments normally insure mandatory field placement. Therefore, it might be easier to make these courses mandatory when suftcient opportunities are available.

- Depending on the company and/or country, paid internships and placements may be the only option. Some unions do not support unpaid internships in their institutions. Since paid internships are very limited, this creates a major obstacle for potential host companies.

- The evaluation of courses may be limited to self-reporting by students and the evaluation of field supervisors. A lack of commitment on the part of field supervisors or firms/agencies may affect the evaluation of the experience. Addressing this challenge requires close collaborations between the university and field placement supervisors.

- Unlike conventional curricula, the added course load for faculty members may be challenging.

- Identifying a diverse range of field placement positions is challenging and may be overcome with time by creating a network of interested institutions.

- Based on the experience of York University, businesses have demonstrated interest in placing recently graduated students or those pursuing an advanced degree. While this is an opportunity for some, it poses a challenge for undergraduate students.

Conclusions and Recommendations

- Internships and field placements provide valuable opportunities for both students and organizations to enhance disaster risk management and business continuity education as well as practice.

- Field placements (such as those arranged by York University) reveal substantial bilateral benefits associated with experiential education courses.

- Local, regional, national, and international agencies should encourage their private sector partner agencies to create internships and field placements for students in the areas of disaster risk management and business continuity.

- There is a need for better ways to enable small and medium size businesses to benefit from internships and field placement opportunities. Business schools may consider creating student-led business continuity and DRR consultancy firms to enable students to provide support to small and medium-size businesses that are unable to accept internships or field placement.

- Consider creating or adapting existing tools to support SMEs—as they develop plans and projects—to reduce their exposure to natural risks disasters.

- Business and industry associations can serve as a bridge between businesses and universities to create field placement and business continuity and DRR opportunities.

- Universities and national and international agencies should recognize participating businesses for their involvement and for providing such opportunities.

- The perspective of learning-by-doing should underpin all internships and placements.

- Stakeholders must work together to overcome institutional challenges that affect the development and outcomes (case studies, availability of information, tools) of internships and placements.

Discussion Topic 4. Research Opportunities

Moderator: Fundação Getulio Vargas, Escola de Administração de Empresas de São Paulo (FGV-EAESP)

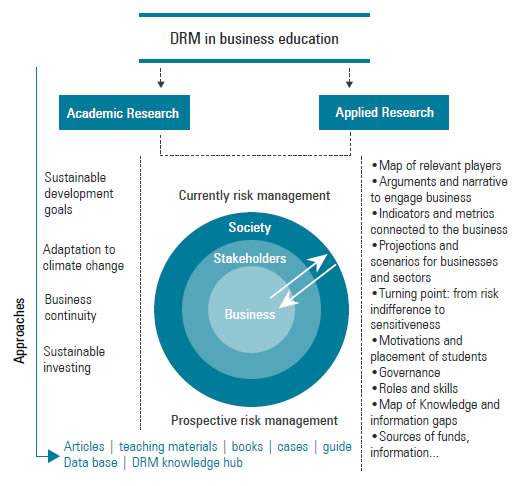

The diagram below, prepared below by the Center for Sustainability Studies at the Getulio Vargas Foundation, School of Business Administration, served as a point of reference for the discussion on research opportunities.

Opportunities

- Research on the impact of disasters, particularly with regard to the financial cost, as it is very hard to come by. This is a common problem in most countries. It would be advantageous to engage in collaborative research on the impact of disasters on businesses, as soon as possible after the event. Research outcomes will yield realistic and convincing arguments for companies to adopt a DRM perspective.

- Produce a publication, or more than one, that includes an introduction about disaster risk management in business education; evidence-based information

that supports the case for for this synergy; and the white papers and case studies developed. Participants recognize that an undertaking of this magnitude presents a significant challenge that will require external funding.

- Collaboratively, develop a survey to be given to students taking DRM courses in the universities participating in this workshop. Apply the survey before each course to understand their initial interest in DRM. A follow-up survey would gauge how they applied their improved knowledge. Results would point to areas of potential comparative research, such as comparisons between students from different countries; between similar courses (what interested a student in this particular course); and between different courses (e.g., DRM in climate change-related courses vs. DRM in business continuity courses).

Challenges

- To address the challenge of a disconnect between teaching the theory of DRM in business education courses and real issues in the business world, identify several key disciplines in business schools into which DRM could be mainstreamed. This will also help overcome the scarcity of research opportunities and topics and advance DRM from a purely theoretical issue to a field of practice.

- Another challenge is deciding the type of journal in which to publish DRM research—whether a standard business journal or a journal related to sustainability, ethics or corporate social responsibility. For example, an analysis of DRM through the lens of adaptation could be published in a journal focusing on climate change, while a similar analysis, but from business competitiveness perspective, could be published in a management journal.

- Funding is an important challenge related to research development, particularly complex research. Researchers must consider the trade-offs between available resources (e.g., time, staff) and the products to be created. Doing one thing well is preferable to doing many things superficially. To address the challenge of funding, develop a collaborative proposal and seek funding from interested countries/businesses.

Conclusions and Recommendations

- In the short term, the first steps may be a) to develop an article about the impact on and losses to a business as a result of a disaster and b) prepare the survey for students taking DRM courses at participating universities. A longer-term objective would be to prepare a publication as mentioned in the section on opportunities.

- A next step is to create a network of participating universities to prioritize the issues identified as opportunities in this forum, and seek funding for further research related to DRM and business management.

Discussion Topic 5. Partnerships and Collaboration

Moderators: ESAN Graduate School of Business & Mona School of Business and Management – University of West Indies

The group identified three levels of partnership, each presenting different concerns and possibilities.

- There is the potential to identify partners and opportunities for collaboration in networks of business schools, with leadership from Florida International University and support from UNISDR (Private Sector Alliance for Disaster Resilient Societies). Another possibility is an international observatory, which could provide evidence on innovative DRM trends in business and industry, as well as their impact on the economy and society.

- There are potential partners and collaborators within university systems, upon whom the successful inclusion of DRM will depend. These include university administrators, lecturers/trainers, students, and university bodies conducting research on disaster risk management.

- There are potential partners external to university networks, including stakeholders whose practices can and should be modified to encompass DRM. Among these are businesses, governments (their perception of the place of business in DRR and the role they might play in DRR policy planning and implementation), and national organizations dealing with hazards.

Opportunities for partnerships include:

- Internships;

- Networking;

- International Observatory;

- Research;

- Shared experience;

- Developing case studies.

The Getulio Vargas Foundation (Brazil) and Concordia University (Canada) highlighted the importance of partnerships in their programs. However, the network must identify the goals and objectives of developing partnerships to mainstream DRR; what resources are required; the existing capacity; and outstanding needs.

Specific, Immediate, and Long-term Opportunities

- Publish the White Papers prepared for this workshop on the UNISDR website.

- Publish a book on disaster risk management and business using the White Papers and the discussions at the Toronto meeting.

- Create a partnership, led by Concordia and York Universities, to develop a proposal to fund research by the end of 2016.

- Convene panel discussions for upcoming academic conferences:

- Mona School of Business & Management Conference. Kingston, Jamaica, 9-11 November 2016

- Academy of International Business Conference. Lima, Peru, 8-10 March 2017.

- Form a partnership, led by York University, to conduct research on post-disaster response.

- Develop case studies and other content for DRM curricula. Partners can focus on specific themes according to their area of expertise. The Sendai Framework for Disaster Risk Reduction may serve as a guide.

- Partner with Florida International University to deliver DRR training to SMEs.

- Create visiting research fellowships to exchange expertise.

- Include business and professional associations as part of the network's programs and activities; they have greater access and the ability to reach companies, especially SMEs.

- Call on the extended business community to lead the process. This includes engaging groups that are not necessarily businesses but suppliers or clients in order to influence behavior change among businesses.

- Learn from each other's experience (e.g. York University, regarding the development of new curricula; Brazil's experience with a climate approach; Indonesia's executive development program, etc.).

- Engage existing organizations that produce technical information on DRR to avoid duplication. Use databases such as the international disaster database EM-DAT (University of Louvain, Belgium). The UNISDR has improved its database, soon to be re-launched on the Prevention website. These existing resources and organizations should be seen as resources to be accessed and utilized where necessary.

- Partner with international development agencies and the U.N. in the development of material (via ARISE), such as case studies; development of topics, and the identification of subject matter experts.

- The network of business schools could partner to arrange a parallel workshop at the 2017 Global Platform for Disaster Risk Reduction, to be held in Cancun, Mexico.

Challenges

- Begin by determining if the institutions participating in this workshop constitute a network. Identify the next steps to taken.

- Clearly define goals and assign coordinators/owners to tasks.

- Overcome funding diftculties.

- Recognize that the time available to develop activities and collaboration among participants is limited.

- How to create demand on the part of students and professionals to participate in DRM courses.

- How to achieve change within existing university systems that is conducive to creating or modifying programs.

Conclusions and Recommendations

- Call on the extended business community to lead the process.

- Use the experience of institutions that have already tackled some of the challenges.

- Win over partners and collaborators by demonstrating tangible results and providing incentives for others to join:

- To funders such as ARISE: the Toronto Workshop, the White Papers; the Emerald publication.

- To the private sector – demonstrate the benefits and opportunities inherent in DRR.

DISASTER RISK MANAGEMENT IN BUSINESS EDUCATION: AREAS OF FOLLOW-UP

Moderator: Universidad EAFIT

Teaching Opportunities and Curriculum Development

Goals

- a. Co-create and/or co-develop teaching materials in DRM for business-related programs.

- Activities:

- Design and share potential course outlines.

- Write teaching cases on business successes/failures in DRM.

- Develop technical modules on standardization for DRM (e.g. training in ISO 22301).

- Design technical courses on disaster preparedness, such as business survival in a non-technical environment.

- Design specific, stand-alone modules to be integrated into existing courses on strategy management, sustainability management, operations management, risk management, CSR, and business ethics.

- b. Promote business start-ups.

- Activities:

- Design and implement a business case competition.

- c. Integrate experiential learning in DRM in business education.

- Activities:

- Design DRM simulation exercises to be used in the classroom.

- Design board games inspired by the Celsius game, designed by FGV.

- Adapt/reproduce the business continuity planning tool developed by York University.

- d. Integrate service learning in DRM in business education.

- Activities:

- Class projects for students doing junior-level consultancies in SMEs and community based organizations.

Professional Development and Extension Programs

Goals

- a. Identify specific skills and competencies needed for disaster risk management.

- b Create a job market in business for those with specific skills and competencies in DRM.

- Activities:

- Develop a ''recruiter buy-in'' package.

Internships and Placement

Goals

- a. Facilitate faculty and student exchange programs for participation in courses/ initiatives in universities with a specialized knowledge of DRM.

- b. Replicate the model of in-service learning based on the pasantia (short-term internship) from FIU.

Research and Publications

Goals

- a. Identify the 'business case' for disaster risk management.

- Activities

- Identify the value proposition of DRM.

- Identify specific competitive and comparative advantages of DRM.

- b. Map the players, existing sources, and define the state-of-the-art in DRM.

- Activities:

- Conduct a meta-analysis /systematic literature review on DRM.

- Prepare an inventory of non-academic literature.

- d. Develop a critical review and understanding of DRM in business and business resilience.

- Activities:

- Define what constitutes a resilient business.

- Identify when resilience can be positive/negative.

- Identify mechanisms to measure the impact of resilience.

- d. Prepare arguments and a narrative to engage small, medium and large companies in DRM.

- Activities:

- Identify the indicators and processes of companies that should be associated with DRM.

- Determine the metrics to be calculated to present to business leaders.

- Understand which projects and scenarios make sense for key sectors.

- Identify leaders in different sectors that can 'champion' the initiative and mobilize their colleagues.

- e. Expand knowledge boundaries

- Activities:

- Identify similarities/differences between the fields of strategy management, risk management and sustainability management.

- f. Advance existing literature and reach out to other industries.

- Activities:

- Advance the academic literature on real option analysis in the field of DRM (find applications to industries other than oil and gas).

- Build a body of literature on prospective risk management.

- g. Develop evidence-based research on business and DRM.

- Activities:

- Identify or write business case studies on the successes/failures of DRM. (i.e. institutional reaction to the hurricane Patricia in Mexico; supply chain management in disasters in Japan; small islands' response to disasters in Jamaica; oil and gas in Indonesia, etc.).

- h. Diagnosis of the international status of DRM in business education.

- Activities:

- Conduct a survey in business schools that are already part of the network.

- i. Publish White Papers developed for this workshop in an indexed/peer-reviewed publication.

- Activities:

- Adapt White Papers to the requirements of the publisher (referencing style, number of references, structure, abstract, word count, etc.).

- j. Highlight the important of the local context, regional realities and global trends.

- General recommendations:

- Frame initiatives around specific local contexts. Take into account regional institutional realities and background, and global trends.

- Provide contexts that would increase understanding of local dynamics and implications of disasters on business. (''What might be a local emergency in one country, may constitute a national catastrophe in another, dramatically affecting the GDP.)

- k. Identify key research questions/focuses.

- Questions and Themes:

- Business governance of DRM.

- Climate change and DRM.

- Integration of DRM into the international agendas on sustainable development or climate change/adaptation.

- Implementation of the Sendai Framework agreement in the business sector.

- DRM in the informal sector.

- DRM in SMEs.

- DRM in business education in the framework of Principles for Responsible Management Education.

- What constitutes a turning point from risk indifference to risk sensitivity?

- Motivations and placement of students.

- Governance.

- Roles and skills.

- Map of knowledge and information gaps.

- l. Mini-grant for evidence-based case studies of successes/failures of business approaches to DRM.

- Questions and Themes:

- Business governance of DRM.

- Climate change and DRM.

- Integration of DRM into international development agendas.

- Implementation of the Sendai Framework agreement.

Partnership and collaboration

Goals

- a. Establishing a business education community of practice (CoP) on DRM.

- Activities:

- Create a formal academic network on DRM in business education, focused on the implementation of the Sendai Framework 2015-2030.

- Identify engagement mechanisms with SMEs, policy makers, and other strategic users.

- Identify 'champions' to move the DRM agenda FORWARD: Alumni, chambers of commerce, local governments, PPP, university-university partnerships, university-industry-governments alliances.

- b. Hosting local/national workshops/public events to multiply the interest and knowledge on DRM for SMEs, and supply chains.

- Activities:

- Design a three-day agenda for a parallel academic event during the 2017 Global Platform for Disaster Risk Reduction in Cancun, Mexico.

ANNEX 1. WHITE PAPERS ON ISSUES RELATED TO DISASTER RISK MANAGEMENT

Concordia University, John Molson School of Business

Kibsey, S. and Walker, T. Research and Teaching on Disaster Risk Management through the Sustainable Financial and Economic System Knowledge-to-Action Network at Concordia University.

Getulio Vargas Foundation, Center for Sustainability Studies

Vendramini Felsberg, Annelise; Casagrande Rocha, Fernanda; Ramos, Ligia; Nicolletti, Mariana Xavier; Camolesi Buimaraes, Thais. Adaptation to Climate Change and Disaster Risk Management in Business Education.

University of the West Indies, Mona School of Business & Management

Minto-Coy, Indianna; Rao-Graham, Lila. Mainstreaming Disaster Risk Management into Management Education.

Gadjah Mada University

Setiawan, Kusdhianto. Mainstreaming Disaster Risk Sensitive Investment Decision Making Analysis in Gadjah Mada School of Business using Real Options Method.

Universidad EAFIT

Herrera-Cano, Carolina; Gonzalez-Perez, Maria Alejandra. Disaster Risk Management in Business Education Entrepreneurial Formation for Corporate Sustainability.

ESAN University, Graduate School of Business

Dejo-Esteves, Cecilia; Parodi-Parodi, Patricia. Disaster Risk Management in Business Education: Proposal to Integrate DRM into Academic Programs.

Florida International University, Extreme Events Institute

Sarmiento, Juan Pablo; Hoberman, Gabriela; Jerath, Meenakshi; Ferreira-Jordao, Gustavo Florida. Disaster Risk Management and Business Education: the Case of Small and Medium Enterprises

Indian Institute of Management Bangalore

Jose, P.D. Sustainability Education in Indian Business Schools: A Status Review.

Monterrey Institute of Technology and Higher Education, School of Business Villasana, Marcia.; Cardenas, Bertha E..; Adriaensens, Marianela.; Trevino, Ana Catalina; Lozano, Jorge. The Case of the School of Business at Tecnológico de Monterrey.

University of Chile

Munoz-Gómez, Leonardo. Business Education and Sensitization for Disaster Risk Management in Chile.

University of Toronto

Tilcsak, András. Teaching Disaster Risk Management at the Rotman School of Management

York University

Asgary, Ali. Mainstreaming Business Continuity Management in Business Educa tion: Why and How Case of York University.