ARTÍCULO ORIGINAL

Detection of Fraudulent Transactions

Through a Generalized Mixed Linear Models

Detección de transacciones fraudulentas a través de un

Modelo Lineal Mixto Generalizado

Jackelyne Gómez-Restrepo1 y

Myladis R. Cogollo-Flórez2

1 Mathematical Engineer, jgomezr7@eafit.edu.co, Masters student, Universidad EAFIT

Medellín-Colombia.

2 Master in Science in Statistics, Ph.D.(C) Systems and computer Engineering, mcogollo@eafit.edu.co, professor, Universidad EAFIT, Medellín-Colombia.

Received:17-feb-2012, Acepted: 18-oct-2012Available online: 30-nov-2012

MSC:62p05

Abstract

The detection of bank frauds is a topic which many financial sector companies

have invested time and resources into. However, finding patterns in

the methodologies used to commit fraud in banks is a job that primarily involves

intimate knowledge of customer behavior, with the idea of isolating

those transactions which do not correspond to what the client usually does.

Thus, the solutions proposed in literature tend to focus on identifying outliers

or groups, but fail to analyse each client or forecast fraud. This paper

evaluates the implementation of a generalized linear model to detect fraud.

With this model, unlike conventional methods, we consider the heterogeneity

of customers. We not only generate a global model, but also a model for each

customer which describes the behavior of each one according to their transactional

history and previously detected fraudulent transactions. In particular,

a mixed logistic model is used to estimate the probability that a transaction

is fraudulent, using information that has been taken by the banking systems

in different moments of time.

Key words: Generalized linear model, transactional history, detected frauds,

outliers detection.

Resumen

La detección de fraudes ha sido uno de los temas en el que muchas compañías

del sector financiero han invertido más tiempo y recursos con el fin de mitigarlo

y de esta forma mantenerse a salvo; sin embargo, encontrar patrones dentro

de las metodologías empleadas para cometer fraude en entidades bancarias es

un trabajo que involucra ante todo conocer muy bien el comportamiento del

individuo, con la idea de finalmente hallar dentro de todas sus transacciones

aquellas que no corresponderían a lo que habitualmente éste hace. De esta

forma, las soluciones planteadas hasta la fecha, para este problema se han

trasladado únicamente a poder identificar outliers o datos atípicos dentro de

la muestra que se está analizando, lo cual no permite analizar cada individuo

de manera individual y mucho menos realizar un pronóstico de fraudes.

En este trabajo se evalúa el uso de un modelo logístico mixto para la detección

de fraudes. Este modelo, a diferencia de los métodos convencionales para detección

de fraudes, considera la variabilidad de las transacciones realizadas por

cada individuo; lo que permite generar no sólo un modelo global, sino también

un modelo por cada individuo que permite estimar la probabilidad de que

una transacción realizada sea fraudulenta, teniendo en cuenta su historial de

transacciones y las transacciones fraudulentas detectadas previamente.

Palabras claves: Modelo lineal generalizado, historia transaccional, fraudes

detectados, detección de outliers.

1 Introduction

Among the methodologies used for detecting fraud through magnetic strip

cards, are those used to detect patterns or anomalies, that determine a fraudulent

action as an event which is not consistent with others, in this way it

takes using data mining tools which use statistics science, optimization and

large volumes of information. [1], since 1997 to 2008, perform a review of

the state of art about applications of data mining in financial fraud detection.

They find that most common data mining techniques applied to detect fraud are methods of classification [2],[3],[4],[5] and clustering [6],[7],[8]. In

[9],[10] the authors review the statistical techniques used for detecting fraud.

Specifically, the most used methodology, for fraud detection through magnetic

stripe cards, is linear discriminant analysis. Similarly, artificial neural

networks (ANN) are used for forecasting this kind of behaviour; in [7] propose

an unsupervised neural network for detecting and creating criteria to

identify suspicious individual behaviours, using trends and characteristics of

individuals. Meanwhile, in [11] proposed a supervised network, using 3 hidden

layers and back-propagation algorithm to determine patterns of fraud. In [12]

makes a comparative research among an ANN, decision trees and Bayesian

networks. With decision trees, branches could gather almost every abnormal

movement, but this kind of model requires an initial analysis of the variables

to determine whether or not independent. The method that worked better was

ANN, followed by the decision tree, and finally Bayesian network. Besides,

about the variables that should be used for detecting fraud, [13] proposed a

detailed research for choosing correctly variables and methodology, they suggest

using amount, type (payment, check, etc.), type of market in which it

was used, channel and check mode (PIN or chip or magnetic stripe). Also they

proposed to use aggregated information from each individual in order to have

all history available, and thereby make predictions of the behaviour of each

person, and when a transaction gets an abnormal patter it will be considered

as an alert to analyse. In many cases, be an expert minimizes the work to

select a methodology and leads to create hard rules that not determine all

abnormal movements, but mostly of them; in [14] are applied different rules

for gain knowledge of patterns of individual transactions. However, as mentioned,

this methodology involves having a vast knowledge of the individual

and the system, as they must create rules based on the history to create implications

that would be used as a criterion for determining whether conduct

is suspected or not (fuzzy logic).

Generally, in the literature there are proposals made for fraud detection through

magnetic stripe cards, which are based on classification and clustering techniques

or ANN, in which individuals are classified according to general rules.

These techniques assume that individuals have a similar variability, a common

pattern, and they do not examine individual variability for each client in their

financial transactions. This is a disadvantage and may lead to problems in the

quality of detection because not all individuals operate equal; in real life each individual has a unique behaviour that should be studied as such. This paper

proposes the use of a mixed logistic model to determine suspicious transactions

through transactional information of individuals. As well as estimating

fraud within the organization, the model determines a model for each client,

taking into account individual behaviour.

This paper is divided into five sections, first one describes an overview about

theory of linear mixed models, the second part has information about theory

of generalized linear mixed models, the mixed logistic model is considered as

a particular case, third section presents the use of mixed logistic model to

detect fraud, and finally conclusions and references are presented.

2 General Linear Model with Mixed Effects

Linear mixed models have been increasing their popularity in applied statistics

literature for health sciences, because they represent a powerful tool to

analyse data with repeated measures, frequently obtained in studies of this

area. The existence of repeated measurements requires special attention to

the characterization of random variation in data. In particular, it is important

to explicitly recognize two levels of variability: random variation between

measures within a particular individual (intra-individual variation) and random

variation between individuals (inter-individual variation). The linear

mixed model considers these sources of variation and can be defined by the

following two steps:

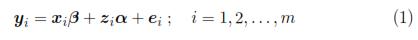

Step 1: Modelling intra-individual variation.

Suppose that for the i-th of m individuals, ni responses have been observed

and that a total of N =

ni data are available. Let be yi the vector of responses for the individual i-th, which satisfies

ni data are available. Let be yi the vector of responses for the individual i-th, which satisfies

where β is a vector of parameters (p x 1) that corresponds to the fixed

effects, xi is a matrix for the i-th individual which characterizes the

systematic part of the answer; αi is a vector (k x 1) characteristic of

the i-th individual, zi is a design matrix (ni x k) and ei is the vector

of intra-individual errors. Assumes that ei  Nni(0,Ri), where Ri is a covariance matrix intra-individual of size (ni x ni). So, from model (1):

Nni(0,Ri), where Ri is a covariance matrix intra-individual of size (ni x ni). So, from model (1):

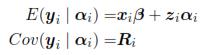

Step 2: Modelling inter-individual variation.

Suppose that the vector of random effects αi is obtained from a normal

distribution with mean zero and dispersion matrix D(k x k); besides assume

that αi; i = 1, ... ,m, are mutually independent. So, under these

assumptions:

That is, the model (1) with the above assumptions for ei and

αi implies

that yi is a multivariate normal random vector of dimension ni with a

particular form of covariance matrix, it means: yi  Nni(xi,β, Vi). The

shape of Vi implies that the model has two different components of variability,

the first one refers only to the variation within individuals (Ri)

and the second one refers to the variation between individuals (D).

In the adjustment process of a mixed model is common to consider

three components: the estimation of fixed effects (β), the estimation

of random effects (αi) and the estimation of covariance parameters (D y Ri)[15]. The standard approach under the multivariate normality

assumption is to use the method of maximum likelihood (ML) and restricted

maximum likelihood (REML). Although Bayesian concepts are

also used to estimate αi.

Nni(xi,β, Vi). The

shape of Vi implies that the model has two different components of variability,

the first one refers only to the variation within individuals (Ri)

and the second one refers to the variation between individuals (D).

In the adjustment process of a mixed model is common to consider

three components: the estimation of fixed effects (β), the estimation

of random effects (αi) and the estimation of covariance parameters (D y Ri)[15]. The standard approach under the multivariate normality

assumption is to use the method of maximum likelihood (ML) and restricted

maximum likelihood (REML). Although Bayesian concepts are

also used to estimate αi.

The next section will present a brief introduction to generalized linear mixed

models, which are extensions of models above but now the response variable

is not continuous.

3 Generalized Linear Mixed Model

Generally, linear mixed models have been used in situations where the response

variable is continuous. However, in practice there are cases where the response may be a discrete variable or categorical; for example, the number of heart

attacks in a potential patient during the last year takes values as 0, 1, 2, ...

In these cases, Generalized linear mixed models (GLMM) are used, a GLMM

is an extension of the linear mixed model where responses are correlated and

can be categorical or discrete variables [16]. To define a GLMM, two stages

need to be mentioned:

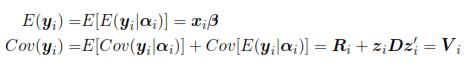

Stage 1: Select a random sample of n individuals from a population of size N.

Attach to the i-th individual an specific parameter αi.

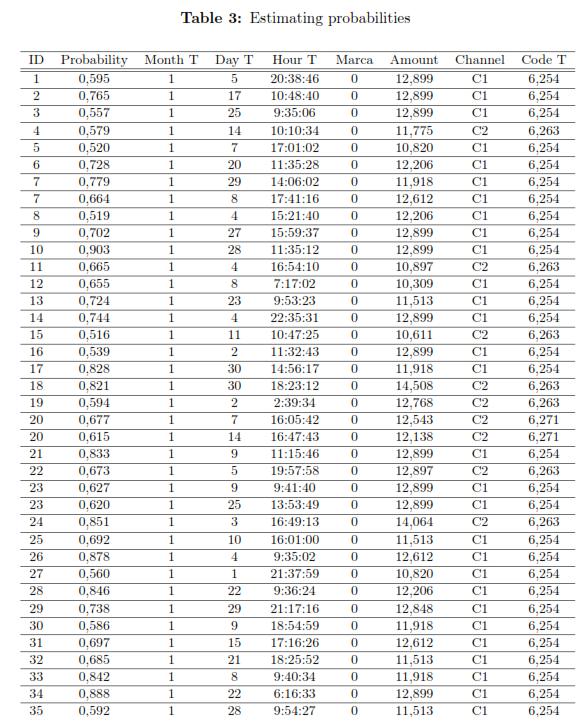

Stage 2: According with αi, select repetitions of [yij, xij];; i = 1, ..., n,j =

1, ... , ni. Suppose that per individual, yilαi the repetitions are statistically

independent, such that:

Where b, a, c are known functions, and ψ is the dispersion parameter

which may be or may be not known. ξi is associated with µi = E(yilαi), which is associated with the linear predictor: ηi = αiz'i + xi β through

a link function g(.), such that g(µi) = ηi. For this case, zi are registered

variables that represent a random effect for the i-th individual.

Models as mixed logistic model, mixed Poisson model, Probit model and

other can be obtained with different link functions.

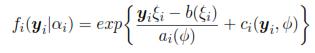

The methodology which was proposed is based on a mixed logistic model;

the model was obtained with a sampling scheme of two stage, where yilαi Ber(pi) is assumed i.i.d., and with pi = P(yij = 1lαi). Also, the link function

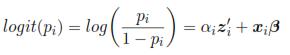

is a logit:

Ber(pi) is assumed i.i.d., and with pi = P(yij = 1lαi). Also, the link function

is a logit:

A logistic model with random intercept is obtained if zij = 1.

Where α1, ... , αn are i.i.d., such that αi  hα(θ).

hα(θ).

Note that this type of model can be extended to case where yilαi  Multinomial(p1,..., pk). So, the model can predict the likelihood that

a subject belongs to one of the k groups. The model's predictive ability is

assessed by comparing the observed data and the predicted data; the model

classifies individuals in each group defined by the dependent variable based

on a cut off point set for the predicted probabilities from the estimated coefficients

and the value taken for each explanatory variable. [17].

Multinomial(p1,..., pk). So, the model can predict the likelihood that

a subject belongs to one of the k groups. The model's predictive ability is

assessed by comparing the observed data and the predicted data; the model

classifies individuals in each group defined by the dependent variable based

on a cut off point set for the predicted probabilities from the estimated coefficients

and the value taken for each explanatory variable. [17].

The interpretation of coefficients and the criteria of goodness of fit are:

i. Theoretical value and interpretation of coefficients.

The shape of the theoretical value in a logit regression is similar to values

in a multiple regression, and it represents a unique relationship with

coefficients which indicate the relative weight of each predictor. The

calculation of a logit coefficient compares the probability of occurrence

of an event with the probability that it does not happen. β are measures

of changes in the odds ratio [18]. In some cases, the coefficients

are logarithmic values, so they should be transformed to do a correct

interpretation of them; taking into account that a positive coefficient

increases the probability of occurrence while a negative has an opposite

effect.

ii. Model evaluation.

Logit models with random intercept, unlike linear models, are not assessed

with the R2 or through the AIC coefficient, because the methods

for calculating them require a high complexity, computation time and

perhaps, in many cases, the methods cannot converge. So that, rates

and indicators are used to get an idea of model behaviour:

Misclassification rate: Refers to the probability of classifying a 0 as 1 or

vice versa.

Good classification rate: Refers to the probability of classifying a 1 as 1

or vice versa.

Specificity: Refers to the probability of classifying a 1 as 1 given that it

is 1.

Sensitivity: Refers to the probability of classifying a 0 as 0 given that it

is 0.

4 GLMM for detecting fraud transactions

According to the literature, the use of classification and clustering techniques

have been proposed for the detection of fraud through swipe cards [2],[3],[4],[5],

[6],[7],[8],[9],[10]; but, these techniques just create a classification rule assuming

that all individuals have an average behaviour, so that they cannot to

estimate (on-line) the probability that a transaction is fraudulent. Also, their

theoretical development is built under the assumption that there is only one

observation for each client, so these techniques are not available to read repeated

measures (number of observations) of each individual.

In practice, it is known that individuals perform several transactions and that

not all clients have the same pattern of behaviour; due to that, it is interesting

to apply other techniques that forecast the probability that a transaction is

fraudulent, and also consider each client as an entity whose variability between

his/her transactions defines an unique profile. One of the statistical

techniques designed to measure this, is the mixed logistic model.

In this section, a mixed logistic model is performed using real data, with the

intention of showing the feasibility of this kind of model and its benefits (in

terms of model quality). As well, there is a comparison between the results

obtained and a conventional detection technique.

4.1 Sample

The methodology of fraud detection through magnetic stripe which is proposed

in this paper is based on a logistic mixed model with random intercept.

The data are storing into a file that consolidates daily national transactions

of clients, taking only those that correspond to payments through two selected

channels. With this information it is possible to identify the type of

transaction, the date, time and place where it was made. Additional to this

transactions file, there is a file with fraud detected transactions (which will be

used to construct the variable Marca) conducted through these channels, these

transactions have been detected and confirmed by the clients, thus facilitating

the process for building a supervised model such as the logistic model with

random intercept; besides, the volume of transactions is sufficient information

to develop a model per individual.

4.2 Preliminary Analisys

Due to the different measurement scales and magnitude of the values displayed

by the variables that are going to be used as regressors, it was necessary

to perform a transformation of them (like creating categories and transformations

through logarithmic functions) in order to have them at the same level

and thus improving the fit of the models.

Subsequently, because the logistic model with random intercept assumes that

the observations are independent, a test of runs was implemented; the results

obtained are shown in Table 1. Using the mean as a measure for calculating

the runs, most of the amounts of the individual transactions were categorized

as independent (random). In particular, for the client 1 were obtained 8 runs.

4.3 Selection of variables

In the database there are two groups: that one where there are clients who

were victims of fraud during a defined time period, and another one where

there are persons who have not detected any fraudulent transactions. Using

these groups, the response variable is defined as y: Marca (fraudulent

transaction). Note that the observed variable is Bernoulli type. The possible

independent variables in the model initially are: identification number (ID),

type of ID, month, day and time when the transaction occurred, the device

used for made the transaction, the channel used for the transaction (channel

1 or channel 2), the name and location of the device, the type of transaction

(withdrawal, payment or transfer), the result of the transaction (successful

or not ), the transaction amount (amount), type of individual (individual or

business), date when individual is linked to the organization, monthly income

and expenses of individuals.

Subsequently, the correlation coefficients between these variables were examined.

According to the results, there is a significant correlation between the

ID, type of ID and date when the individual got linked to the organization,

this relation is expected because there are people of all ages who are linked to

the bank after obtained their majority; it is also possible to find individuals,

business or foreign persons, leading to different types of Nit.

Additionally, the month of the transaction is related to the amount of the

transaction (r = 0.8, p - value < 0.05), and to the existence of fraud (r =

0.862, p - value < 0.05); this is explained by the fact that there are months

in which people must make more payments than others (start year, end of

year). In addition, according to information provided by the experts, there

are months where fraud is most evident.

Variables as day and hour of the transaction are correlated with the rest of the

variables; however the relation is not statistically significant. The relation is

produced because there are certain days of the month with most probability

to have transactions and obviously there are individuals who manage sums

higher than average people (or vice versa).

The transaction amount is related to the existence of fraud (r = 0.82, p -

value < 0:05), it is understood because there is fraud just if people withdraw

money, which is equal to say that the transaction amount is greater than 0.

Similarly, this variable depends on the transaction code (r = 0.9, p - value <

0:05) (which is linked directly to the device), so the existence of fraud is related to the device, although it can be due to that most of detected fraud have

been made through ATMs.

The value of incoming and outgoing, are related to the amounts of the transactions

(people do not spend more money than they have in their savings

accounts), and the day (in some days there are more transactions).

Moreover, when considering the variable Marca, there is a relationship between

it and the month of the transaction. It has significant correlation with

variables such as day of the transaction (r = 0.93, i - value < 0:05), hour

of transaction (r = -0:96, p - value < 0:05), the transaction code and the

transaction amount.

Finally, the explanatory variables, related to the absence or presence of fraud,

are: channel, device code, transaction amount, month, day and time of the

transaction.

However, given that fraud can be categorized using variables such as the type

of device and therefore the type of transaction, they are not going to be

eliminated (represented by transaction code). While variables like: Total

Debts, Nit type, incoming, outgoing and document type are discarded to fit

the model.

4.4 Model

The proposed model considers a random intercept per individual which represents

the variability of each of them. This intercept is assumed to be a

random variable distributed N(0, σ2), so estimating it, generates a fraud detection

model per person due to the model is taking into account the variability

of each transactions per individual. However, every estimated models have in

common the coefficients associated with the rest of explanatory variables.

In this model, the value of the coefficient indicates the importance of its associated

variable, for this reason, the classifications of transactions will be

calculated using the weight (coefficient) associated to each variable; a negative

value decreases the probability of a fraud (Marca=1), while a positive

value means that the probability increases [19].

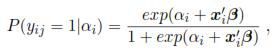

It was adjusted using the GLMM package of R, with a database which contains

799 fraud detected transactions and 4854 transactions in a defined period of

time. The results are shown in Table 2.

To estimate the model, some transformed variables were used to have

consistency between the weights of each variable (coefficients); but according

with the results, the variable related to the day when the transaction was

made, is not significant, however, intuitively, this variable does not have multicolineality

with others because its standard deviation is not very large; so,

under supervision, this variable will be used for estimating the model.

On the other hand, the month and the amount of the transaction are the variables

that contribute most to the weight; however the month is the variable

that most decreases the probability, while the amount increases the probability.

The day and the code of the transaction have the lesser weight, so they

contribute less (in a negative way.) In general terms, the model fitted to the

i-th individual is

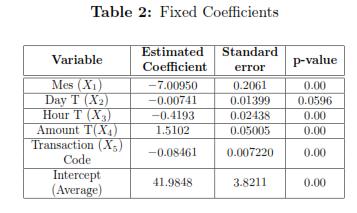

To specify the model for the individual i, the estimation of its intercept i

must be considered. In the results, it is observed that for any individuals

the month of the transaction, date, time and code transaction contribute

negatively to the likelihood that the transaction be suspicious, but as increases

the amount of the transaction , the likelihood also increases. Table 3 shows

the estimated probabilities of fraud for some individuals in the database.

4.5 Model Evaluation

As indicated by [1], when a fraud detection model is estimated, it is necessary

to take into account the sensitivity and specificity of its classification.

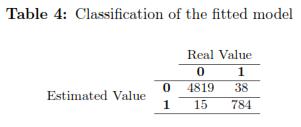

From the information shown in Table 4, specificity, sensitivity, bad classification

rate (bcr) and good classification rate (gcr) were calculate: bcr=0.009371

gcr=0.9906 sensitivity=0.9922 specificity=0.9812 According to the literature

it is preferable to have a lower misclassification rate because it indicates that

the model has few mistakes, while the value of the rate of good classification

(gcr) close to 1 is preferred. The sensitivity measures how good are the

classifications of the model with the true positives, and specificity measures

how good are the classifications of the model with the true negatives. The

estimated model with random intercept has very good results, but it is clear

that frauds are subject to verification.

According to tests conducted with other mixed logistic models with different

combinations of variables, the model with better results in terms of gcr, bcr,

sensitivity and specificity was the proposed one in this section.

4.6 Comparison with an Artificial Neural Network

In order to evaluate the performance of a mixed logistic model in comparison

with the traditional techniques for detecting fraud, an Artificial Neural

Network (ANN) was implemented using the variables which were utilized for

estimating de mixed logistic model; also, different network architectures were

applied. The ANN was selected because is the conventional method that has

shown better results [see [12]].In this case it was found that the ANN did not

perform as well as the mixed logistic model. The best ANN was trained using

variables like Day T, Hour T and Amount T, its rates were: gcr = 0.8587,

bcr = 0.1515, sensitivity= 0.8048 and specificity= 0.8959; while rates for the ANN that was trained with the same variables using in the fitted mixed logistic

regression were: gcr = 0.8233, bcr = 0.1868, sensitivity= 0.7594 and

specificity= 0.8714. The weak results, obtained from the ANN, can be related

to the methodology used in the ANN because it estimated a general model

for individuals and it was not possible to obtain a model per person as it does

the logistic mixed model, that considers the different behaviours of clients.

5 Conclusions

According to the correlation analysis between variables, the found relationships

coincide with the information provided by the experts. In this way,

arguably that fraud is stationary, so it has to be analysed taking into account

the month, the day and the hour of the transactions. Besides, type, amount

and channel of the transaction should be used for fitting the model and for

determining patterns for different types of fraud.

The generalized linear mixed model generates favourable results; however, it

is necessary running the model for each individual as it is built with random

intercepts unique per person. This, though computationally can be a

disadvantage, within models is an advantage, as it would have a single representation

to describe the variability of each individual. But, a high volume of

historical information is required to build a profile per individual and estimate

more precise models with a high quality outputs.

As future work, it is proposed estimating the model to groups of individuals

more susceptible according to its characteristics (females, old people); on the

other hand, it is also possible to fit a more complex model, involving variables

such as type of fraud, other kind of transactions (not only financial), among

others.

References

1. E. Ngai, Y. Hu, Y. Wong, Y. Chen, X. Sun, ''The application of data mining techniques

in financial fraud detection: A classification framework and an academic

review of literature'', Decision Support Systems, vol. 50, n.o 3, pp. 559-569, feb.

2011. Referenced in 222, 234

2. P. Chan, W. Fan, Andreas, A. Prodromidis, S. J. Stolfo, ''Distributed Data

Mining in Credit Card Fraud Detection'', IEEE Intelligent Systems, vol. 14, n.o

6, pp. 67-74, 1999. Referenced in 223, 228

3. J. Dorronsoro, F. Ginel, C. Sanchez, C. Cruz, ''Neural fraud detection in credit

card operations'', IEEE Transactions on Neural Networks, vol. 8, n.o 4, pp. 827

-834, jul. 1997. Referenced in 223, 228

4. I-C. Yeh, C. Lien, ''The comparisons of data mining techniques for the predictive

accuracy of probability of default of credit card clients'', Expert Syst. Appl., vol.

36, n.o 2, pp. 2473-2480, mar. 2009. Referenced in 223, 228

5. T-S. C. Rong-Chang Chen, ''A new binary support vector system for increasing

detection rate of credit card fraud.'', International Journal of Pattern Recognition

and Artificial Intelligence (IJPRAI), vol. 20, n.o 2, pp. 227-239, 2006.

Referenced in 223, 228

6. Abhinav Srivastava, Amlan Kundu, Shamik Sural, Arun K. Majumdar. Credit

card fraud detection using hidden Markov model. IEEE Transactions on Dependable

and Secure Computing, vol. 5, no1, pp. 37-48, 2008.

Referenced in 223, 228

7. J. Quah, M. Sriganesh, ''Real-time credit card fraud detection using computational

intelligence'', Expert Systems with Applications, vol. 35, n.o 4, pp. 1721-

1732, nov. 2008. Referenced in 223, 228

8. Vladimir Zaslavsky, Anna Strizhak, ''Credit Card Fraud Detection Using Self-

Organizing Maps'', Information & Securit, vol. 18, n.o 48, pp. 48-63, 2006.

Referenced in 223, 228

9. R. Bolton, D. Hand, ''Statistical Fraud Detection: A Review'', Statist. Sci., vol.

17, n.o 3, pp. 235-255, ago. 2002. Referenced in 223, 228

10. Linda Delamaire, Hussein Abdou, John Pointon, ''Credit card fraud and detection

techniques: a review'', Banks and Bank Systems, vol. 4, n.o 2, pp. 57-68,

2002. Referenced in 223, 228

11. E. Aleskerov, B. Freisleben, y B. Rao, ''CARDWATCH: a neural network based

database mining system for credit card fraud detection'', in Computational Intelligence

for Financial Engineering (CIFEr), 1997., Proceedings of the IEEE/IAFE 1997, 1997, pp. 220 -226. Referenced in 223

12. E. Kirkos, C. Spathis, Y. Manolopoulos, ''Data Mining techniques for the

detection of fraudulent financial statements'', Expert Systems with Applications,

vol. 32, n.o 4, pp. 995-1003, may 2007. Referenced in 223, 234

13. C. Whitrow, DJ. Hand, P. Juszczak, D. Weston, ''Transaction aggregation as a

strategy for credit card fraud detection'', Data Mining Knowledge Disc, vol. 18,

n.o 1, pp. 30-55, 2009. Referenced in 223

14. D. Sánchez, M. A. Vila, L. Cerda, y J. M. Serrano, ''Association rules applied

to credit card fraud detection'', Expert Systems with Applications, vol. 36, n.o 2,

Part 2, pp. 3630-3640, mar. 2009. Referenced in 223

15. Helen Brown, Robin Prescott. Applied Mixed Models in Medicine, Statistics in

Practice, 2001. Referenced in 225

16. ''Mixed Models: Theory and Applications''. [Online]. Available:

http://www.dartmouth.edu/

[Accessed: sept-2011]. Referenced in 226

17. M. Quintana, A. Gallego, M. Pascual, ''Aplicación del análisis discriminante y

regresión logística en el estudio de la morosidad en las entidades financieras. Comparación

de resultados'', Pecunia: revista de la Facultad de Ciencias Económicas

y Empresariales, vol. 1, pp. 175-199, 2005. Referenced in 227

18. A. Alderete, ''Fundamentos del Análisis de Regresión Logística en la Investigación

Psicológica'', Revista Evaluar, vol. 6, pp. 52-67, 2006. Referenced in 227

19. Brady West, Kathlen Welch, Andrzej Galecki. Linear Mixed Models: A practical

guide to using statistical software, Chapman & Hall,2007. Referenced in 231

ni data are available. Let be yi the vector of responses for the individual i-th, which satisfies

Nni(0,Ri), where Ri is a covariance matrix intra-individual of size (ni x ni). So, from model (1):

Nni(0,Ri), where Ri is a covariance matrix intra-individual of size (ni x ni). So, from model (1):