Pay as you Go System versus Fully Funded Pension in Peru

Main Article Content

Keywords

Fully Funded, Pay as You Go, Sustainability

Abstract

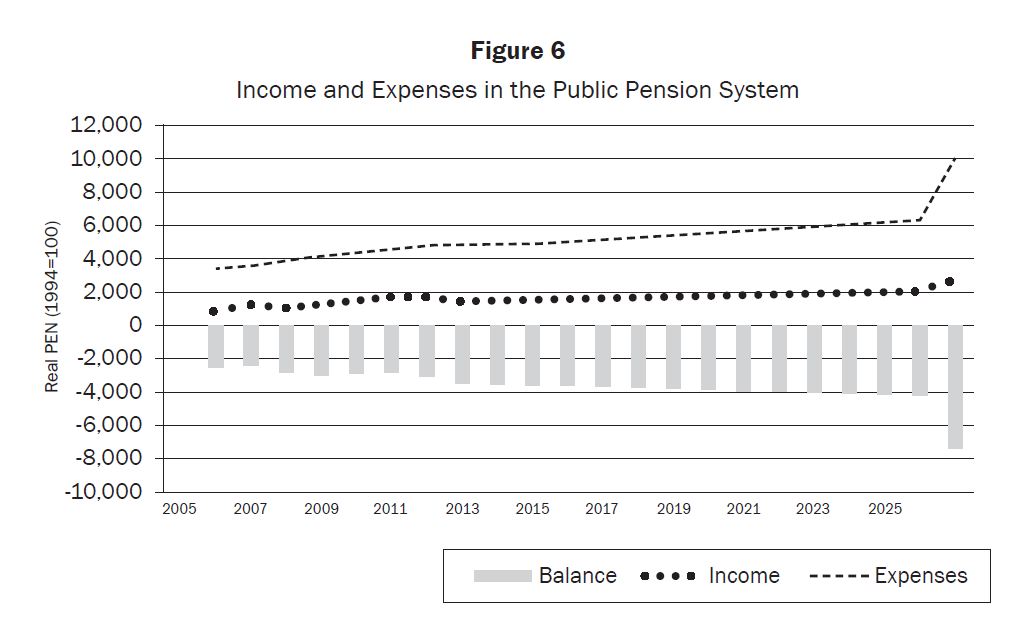

The following paper analyses the sustainability of the Peruvian “Pay as You Go System” which is provided by the Government. In Peru, the “Pay as you Go System” coexists with Private Pension Funds or “Fully Funded Pension”. Sometimes both systems compete with each other with advantages and disadvantages between them. We found that “Pay as You Go System” cannot be sustainable over a long period of time. In addition, based on a comparative analysis of advantages and disadvantages, we propose some recommendations to make Private Pension Funds (Fully Funded Pension) the best alternative to Pay as You Go System.

Downloads

References

Banco Central de Reservadel Perú (BCRP). Memorias y Notas Semanales.

Bernal, N. et al, (2008), "Una mirada al sistema peruano de pensiones: diagnóstico y propuestas". Estudios previsionales del BBVA.

Comisión EconómicaparaAméricaLatinay el Caribe (CEPAL). Datos demográficos de CELADE – División de Población.

Crabbe, Carolin A. (2005) A Quarter Century of Pension Reform in Latin Amereica and the Caribean: Lessons Learned and Next Steps. Washington DC. IDB. 409p

Instituto Nacional de Estadísticae Informática(INEI). Estadísticas y Cuentas Nacionales.

Instituto Nacional de Estadísticae Informática(INEI). Encuesta Nacional de Hogares del 2011.

Kay, Stephen J. & Sinha, Tapen (ed.), 2007. “Lessons from Pension Reform in the Americas,”OUP Catalogue, Oxford University Press, number 9780199226801, March.

Ley 054-97 de Creación del SistemaPrivado de Pensiones Peruano (1997) Texto Unico Ordenado de la Ley del Sistema Privado de Administración de Fondos de Pensiones. Ministerio de Economía y Finanzas.

Ley de Reformade Pensiones 29903 (2012). Comisión Permanente del Congreso de la República del Perú.

Lusardi A., and Mitchell O. (2007) “BabyBoomer retirement security: The roles of planning, financial literacy, and

housing wealth. Volume 54, Issue 1, January 2007, Pages 205–224.

Oficinade Normalización Previsional (ONP). Base de datos del Sistema Nacional de Pensiones.

Piñeira, J., (1991), “El cascabel al gato: la batalla por la reforma previsional”, Editorial Zigzag. Santiago.

Piñeira, J., (1995), "Empowering workers: The Privatization of Social Security in Chile", CATO. Vol. 15, N° 2-3.

Restrepo J., Gutierrez J. (2011) "Valoración de la garantía de pensión en las cuentas de ahorro individual en Colombia", Innovar, vol. 21, No 41, págs. 51-62

Rofman, Rafael et. Al. (2008) “Pension system in Latin America – Concepts and measurements of coverage. Wold Bank. Discussion Paper 0616.

Stiglitz, J. and P. Orszag (1999), “Rethinking Pension Reform: Ten Myths about Social Security Systems”, paper presented at the Conference on “New Ideas About Old Age Security”, 14-15 September, The World Bank, Washington, D. C.

Superintendenciade Bancay Seguros del Perú (SBS). Base de datos del sistema privado de pensiones peruano.