Sistema Individual de Pensiones versus sistema colectivo de pensiones en Perú

Main Article Content

Keywords

Sistema Individual, Fondo provado de Pensiones, Sustenibilidad.

Resumen

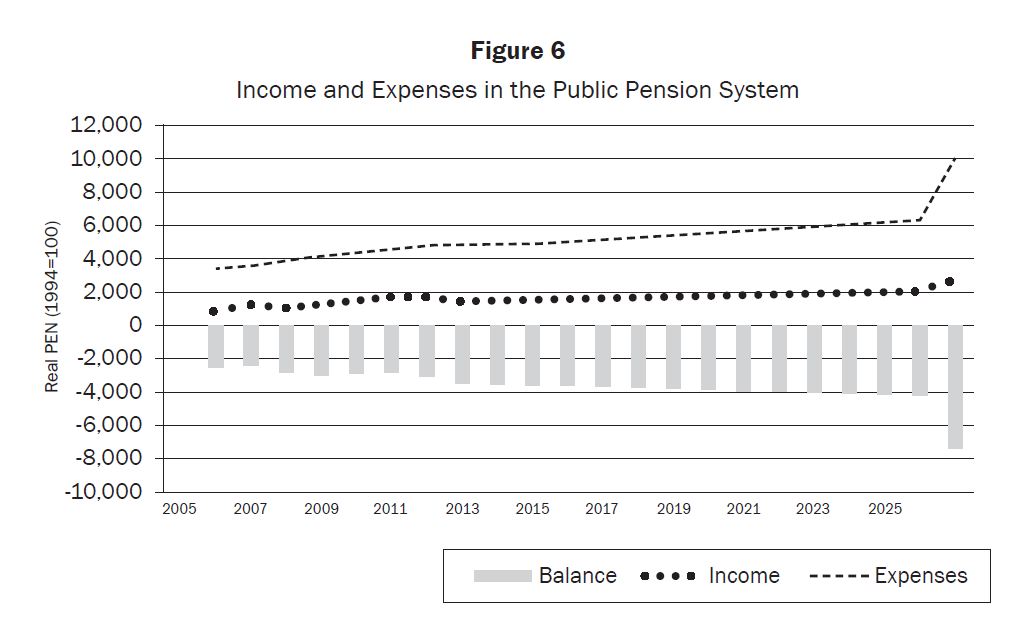

Este trabajo analiza la sostenibilidad del sistema pensional colectivo implementado por el gobierno peruano. En Perú, este sistema coexiste con el de fondos privados de pensiones o fondo individual. En algunos casos, estos dos sistemas compiten entre sí, con sus ventajas y desventajas entre ambos sistemas. Según nuestros hallazgos, el sistema pensional de reparto colectivo de pensiones no es sostenible en un largo plazo. Asimismo, sobre la base de un análisis comparativo de las ventajas y desventajas entre ambos sistemas, se formulan algunas recomendaciones para que los fondos privados de pensión (Sistema Individual) se conviertan en la mejor alternativa al sistema pensional colectivo.

Descargas

Referencias

Banco Central de Reservadel Perú (BCRP). Memorias y Notas Semanales.

Bernal, N. et al, (2008), "Una mirada al sistema peruano de pensiones: diagnóstico y propuestas". Estudios previsionales del BBVA.

Comisión EconómicaparaAméricaLatinay el Caribe (CEPAL). Datos demográficos de CELADE – División de Población.

Crabbe, Carolin A. (2005) A Quarter Century of Pension Reform in Latin Amereica and the Caribean: Lessons Learned and Next Steps. Washington DC. IDB. 409p

Instituto Nacional de Estadísticae Informática(INEI). Estadísticas y Cuentas Nacionales.

Instituto Nacional de Estadísticae Informática(INEI). Encuesta Nacional de Hogares del 2011.

Kay, Stephen J. & Sinha, Tapen (ed.), 2007. “Lessons from Pension Reform in the Americas,”OUP Catalogue, Oxford University Press, number 9780199226801, March.

Ley 054-97 de Creación del SistemaPrivado de Pensiones Peruano (1997) Texto Unico Ordenado de la Ley del Sistema Privado de Administración de Fondos de Pensiones. Ministerio de Economía y Finanzas.

Ley de Reformade Pensiones 29903 (2012). Comisión Permanente del Congreso de la República del Perú.

Lusardi A., and Mitchell O. (2007) “BabyBoomer retirement security: The roles of planning, financial literacy, and

housing wealth. Volume 54, Issue 1, January 2007, Pages 205–224.

Oficinade Normalización Previsional (ONP). Base de datos del Sistema Nacional de Pensiones.

Piñeira, J., (1991), “El cascabel al gato: la batalla por la reforma previsional”, Editorial Zigzag. Santiago.

Piñeira, J., (1995), "Empowering workers: The Privatization of Social Security in Chile", CATO. Vol. 15, N° 2-3.

Restrepo J., Gutierrez J. (2011) "Valoración de la garantía de pensión en las cuentas de ahorro individual en Colombia", Innovar, vol. 21, No 41, págs. 51-62

Rofman, Rafael et. Al. (2008) “Pension system in Latin America – Concepts and measurements of coverage. Wold Bank. Discussion Paper 0616.

Stiglitz, J. and P. Orszag (1999), “Rethinking Pension Reform: Ten Myths about Social Security Systems”, paper presented at the Conference on “New Ideas About Old Age Security”, 14-15 September, The World Bank, Washington, D. C.

Superintendenciade Bancay Seguros del Perú (SBS). Base de datos del sistema privado de pensiones peruano.