Economic fluctuations in a small economy with two productive sectors under a floating exchange rate regime

Main Article Content

Keywords

Business cycles, Fiscal policy, Monetary policy, Exchange rate policy

Abstract

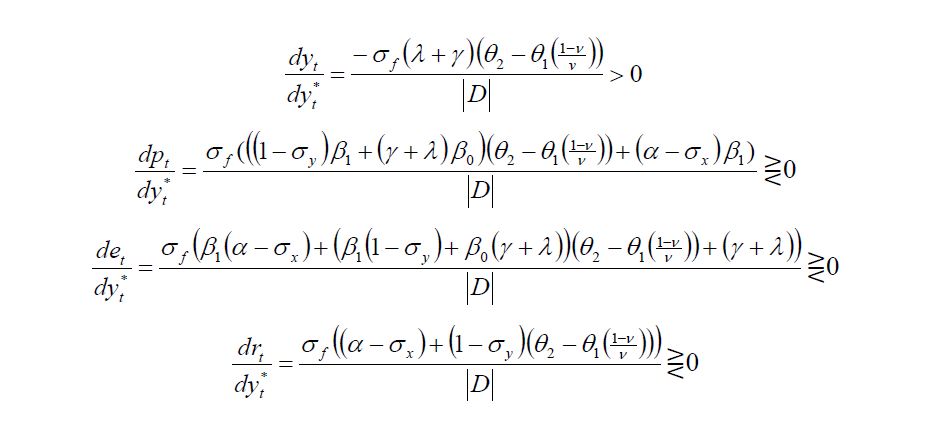

This paper presents a theoretical model of aggregate supply and demand in a small economy with two productive sectors, under a flexible exchange regime and imperfect capital mobility. Only one of the production sectors is assumed to produce an exportable commodity sold at world market prices, while the production of the other sector is assumed to supply the domestic market. This model helps to explain how the impact of both domestic (economic policy, productivity, etc.) and foreign (changes in exchange terms) shocks is spread. In every case studied, results show that real output increases consistently with those cases postulated by economic theory. Conversely, the effects on the price level, the exchange rate and the real interest rate are ambiguous. In terms of domestic shocks, fiscal or monetary policy may be seen as a way to stabilize or stimulate the economy but the costs involved raise the price level.

Downloads

Download data is not yet available.

References

Blanchard, O. J. (1989). A traditional interpretation of macroeconomic fluctuations. American Economic Review, 79, 1146-1164

Blanchard, O. J. & Quah, D. (1989). The dynamic effects of aggregate demand and supply disturbances. American Economic Review, 79, 655-673.

Cartaya, V.; Sáez, F. & Zavarce, H. (2010). Ciclos de actividad económica y comovimientos sectoriales en Venezuela. Serie Documentos de Trabajo, 110. Caracas, Venezuela: Banco Central de Venezuela.

Cecchetti, S. G. & Karras, G. (1992). Sources of output fluctuations during the interwar period: Further evidence on the causes of the great depression. National Bureau of Economic Research. Working Paper, 4049.

Cooley, T. F. & Hansen, G. D. (1997, noviembre). Unanticipated money growth and the business cycle reconsidered. Journal of Money, Credit and Banking, 29, 4 (part 2: Dynamic effects of Monetary Policy), 624-648.

Fleming, J. M. (1962). Domestic financial policy under fixed and under floating exchange rates. IMF Staff Papers, 9, 369-379.

Gali, J. (1999, marzo). Technology, employment, and the business cycle: Do technology shocks explain aggregate fluctuations? American Economic Review, 89, 249-271.

Gordon, R. J. (Ed). (1986). The American business cycle: Continuity and change. Chicago, EE. UU.: The University of Chicago Press.

Karras, G.(1993). Sources of U.S. macroeconomic fluctuations: 1973-1989. Journal of Macroeconomics, 15, 47-68.

Karras, G.(1994). Sources of business cycles in Europe: 1960-1988. Evidence from France, Germany, and the United Kingdom. European Economic Review, 38, 1763-1778.

King, R. G.; Plosser, C. I.; Stock, J. H. & Watson, M. W. (1991, septiembre). Stochastic trends and economic fluctuations. American Economic Review, 81(4), 819-840.

Lorenzoni, G. (2009, diciembre). A theory of demand shocks. American Economic Review, 99(5), 2050-2084.

Mora, J. U. (2002). Inflation, exchange rate instability and balance of payment deficits in Venezuela: A VAR approach. Ph. D. Dissertation. University of Illinois at Chicago, Chicago, Estados Unidos.

Mora, J. U. (2008, enero-junio). Relative importance of foreign and domestic shocks in the Ven¬ezuelan economy. Economía, XXXIII(25), 61-86

Mora, J. U. (2012). Fluctuaciones económicas bajo régimen de cambio fijo en una economía pequeña con dos sectores.

Mimeo. Venezuela, Instituto de Investigaciones Econó¬micas y Sociales-Universidad de los Andes.

Mundell, R. A. (1963). Capital mobility and stabilization policy under fixed and flexible exchange rates. Canadian Journal of Economics and Political Science, 29, 475-485.

Pagliacci, C. & Barráez, D. (2009). Oferta y demanda agregada: una representación de espacio de estados y cambios de régimen. Serie Documentos de Trabajo, 105. Ca¬racas, Venezuela: Banco Central de Venezuela.

Pagliacci, C. & Ruda, M. (2004). ¿Tienen efectos las acciones de política monetaria? Un análisis de intencionalidad. Serie Documentos de Trabajo, 67. Caracas, Venezuela: Banco Central de Venezuela.

Sáez, F. J. & Puch, L. A. (2004). Shocks externos y fluctuaciones en una economía pe¬trolera. Serie Documentos de Trabajo, 59. Caracas, Venezuela: Banco Central de Venezuela.

Blanchard, O. J. & Quah, D. (1989). The dynamic effects of aggregate demand and supply disturbances. American Economic Review, 79, 655-673.

Cartaya, V.; Sáez, F. & Zavarce, H. (2010). Ciclos de actividad económica y comovimientos sectoriales en Venezuela. Serie Documentos de Trabajo, 110. Caracas, Venezuela: Banco Central de Venezuela.

Cecchetti, S. G. & Karras, G. (1992). Sources of output fluctuations during the interwar period: Further evidence on the causes of the great depression. National Bureau of Economic Research. Working Paper, 4049.

Cooley, T. F. & Hansen, G. D. (1997, noviembre). Unanticipated money growth and the business cycle reconsidered. Journal of Money, Credit and Banking, 29, 4 (part 2: Dynamic effects of Monetary Policy), 624-648.

Fleming, J. M. (1962). Domestic financial policy under fixed and under floating exchange rates. IMF Staff Papers, 9, 369-379.

Gali, J. (1999, marzo). Technology, employment, and the business cycle: Do technology shocks explain aggregate fluctuations? American Economic Review, 89, 249-271.

Gordon, R. J. (Ed). (1986). The American business cycle: Continuity and change. Chicago, EE. UU.: The University of Chicago Press.

Karras, G.(1993). Sources of U.S. macroeconomic fluctuations: 1973-1989. Journal of Macroeconomics, 15, 47-68.

Karras, G.(1994). Sources of business cycles in Europe: 1960-1988. Evidence from France, Germany, and the United Kingdom. European Economic Review, 38, 1763-1778.

King, R. G.; Plosser, C. I.; Stock, J. H. & Watson, M. W. (1991, septiembre). Stochastic trends and economic fluctuations. American Economic Review, 81(4), 819-840.

Lorenzoni, G. (2009, diciembre). A theory of demand shocks. American Economic Review, 99(5), 2050-2084.

Mora, J. U. (2002). Inflation, exchange rate instability and balance of payment deficits in Venezuela: A VAR approach. Ph. D. Dissertation. University of Illinois at Chicago, Chicago, Estados Unidos.

Mora, J. U. (2008, enero-junio). Relative importance of foreign and domestic shocks in the Ven¬ezuelan economy. Economía, XXXIII(25), 61-86

Mora, J. U. (2012). Fluctuaciones económicas bajo régimen de cambio fijo en una economía pequeña con dos sectores.

Mimeo. Venezuela, Instituto de Investigaciones Econó¬micas y Sociales-Universidad de los Andes.

Mundell, R. A. (1963). Capital mobility and stabilization policy under fixed and flexible exchange rates. Canadian Journal of Economics and Political Science, 29, 475-485.

Pagliacci, C. & Barráez, D. (2009). Oferta y demanda agregada: una representación de espacio de estados y cambios de régimen. Serie Documentos de Trabajo, 105. Ca¬racas, Venezuela: Banco Central de Venezuela.

Pagliacci, C. & Ruda, M. (2004). ¿Tienen efectos las acciones de política monetaria? Un análisis de intencionalidad. Serie Documentos de Trabajo, 67. Caracas, Venezuela: Banco Central de Venezuela.

Sáez, F. J. & Puch, L. A. (2004). Shocks externos y fluctuaciones en una economía pe¬trolera. Serie Documentos de Trabajo, 59. Caracas, Venezuela: Banco Central de Venezuela.