Impuesto predial y desarrollo económico.Aproximación a la relación entre el impuesto predial y la inversión de los municipios de Antioquia.

Main Article Content

Keywords

Impuesto predial, Salud, Educación, Política fiscal

Resumen

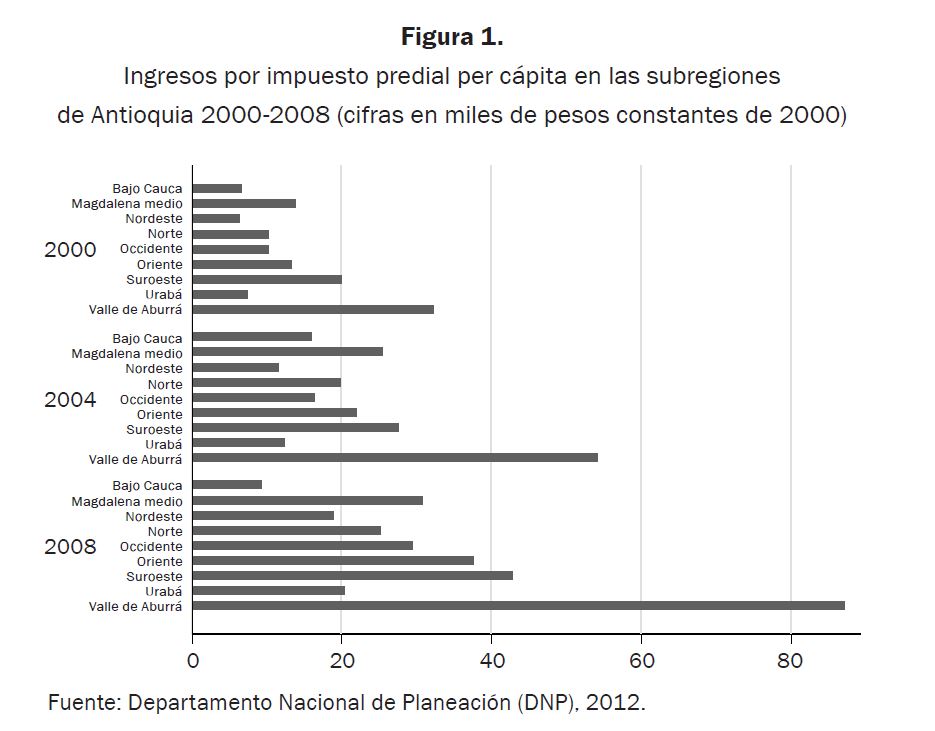

El artículo analiza las relaciones existentes entre los niveles de inversión en salud y educación por parte de los municipios, y el recaudo del impuesto predial. Se utiliza la metodología de panel de datos, entre los años 2000 y 2008, en una muestra de 97 municipios del departamento de Antioquia (Colombia). De acuerdo con los resultados, se logra determinar que no existe ninguna relación entre los niveles de inversión autónoma en educación y el recaudo de impuesto predial; por otra parte, respecto a las inversiones en salud, se identifica que el recaudo del impuesto presenta una relación negativa con las inversiones autónomas. Finalmente, como una extensión del alcance inicial planteado, se logró determinar una relación positiva entre el recaudo de impuesto predial y las inversiones en desarrollo de vías e infraestructura.

Descargas

Referencias

Avi-Yonah, R. & Margalioth, Y. (2006). Taxation in developing countries: some recent support and challenges to the conventional view, 32.

Bahl, R.; Martínez-Vásquez, J. & Youngman, J. (2008). Making the property tax work. Lincoln Institute of Land Policy. Puritan Press.

Bahl, R.; Martínez-Vásquez, J. & Youngman, J (2010). Challenging the conventional wisdom on the property tax. Lincoln Institute of Land Policy. Puritan Press.

Baltagi, B. (2002). Recent Developments in the Econometrics of Panel Data. Edward Elgar Publishing.

Banco Mundial (2011). World Development Indicators. World Bank.

Bardhan, P. (1997). Corruption and Development: A Review of Issues. Journal of Economic Literature , 35, 1320-1346.

Bejarano, J. C. (2008). Bibliografía anotada sobre el impuesto a la propiedad inmobiliaria en América Latina. Lincoln Institute of Land Policy.

Bell, M. E.; Brunori, D. & Youngman, J. (2010). The property tax and local autonomy. Lincoln Institute of Land Policy - Puritan Press.

Brooks, N. & Hwong, T. (2006). The Social Benefits and Economic Costs of Taxation: A Comparison of High and Low-Tax Countries. CCPA - Canadien Centre for Policy Alternatives.

Burguess, R. & Stern, N. (1993). Taxation and Development. Journal of Economic Literature, 31, 762-830.

Carlson, R. H. (2005). A Brief History of Property Tax. Recuperado de: https://secure.sauder. ubc.ca/re_creditprogram/course_resources/courses/content/443/carlson.pdf.

Clavijo, S. (2007). Evolución de la tributación en Colombia y sus desafíos (1990-2006). ¿BOGOTÁ: COLOMBIA? Asociación Nacional de Instituciones Financieras.

Cobham, A. (2005). Tax evasion, tax avoidance and development finance. Oxford, Inglaterra: University de Oxford, Queen Elizabeth House, Finance and Trade Policy Research Centre.

Cobham, A. (2007). The tax consensus has failed. The Oxford Council on Good Governance. OCGG Economy Recommendation No. 8.

Colombia, AsambleaNacional Constituyente (1991). Constitución Política de Colombia, Bogotá.

Colombia, Consejo de Estado, Sentencias, “Fallo 14226 de 2007”, M. P.: Sala, S. C., Bogotá.

Colombia, Departamento Nacional de Planeación, DNP (2010). Desempeño fiscal de los departamentos y municipios (2009). Bogotá, Colombia: Imprenta Nacional.

DeCesare, C. M. (2010). Panorama del impuesto predial en América Latina. Lincoln Institute of Land Policy.

Dodge, T. A. (1996). Alexander. Da Capo Press.

Emran, M. S. & Stiglitz, J. (2005). On Selective Indirect Tax Reform in Developing Countries. Journal of Public Economics, 89, 599-623.

Feres, J. C. & Mancero, X. (2001). El método de las necesidades básicas insatisfechas (NBI) y sus aplicaciones en América Latina. Cepal-Naciones Unidas.

Fergusson, L. (2003). Impuestos, crecimiento económico y bienestar en Colombia (1970- 1999). Desarrollo y Sociedad, 52, 143-202.

Gordon, R. & Li, W. (2005). Tax Structures in Developing Countries: Many Puzzles and a Possible Explanation. National Bureau of Economic Research.

Hsiao, C. (1986). Analysis of Panel Data. Econometric Society Monographs, 11. Cambridge, RU: Cambridge University Press.

Iregui, A. M.; Melo, L. & Ramos, J. (2003). El impuesto predial en Colombia: evolución reciente, comportamiento de las tarifas y potencial de recaudo. Bogotá, Colombia: Banco de la República.

Iregui, A. M.; Melo, L. & Ramos, J. (2005). El impuesto predial en Colombia: factores explicativos del recaudo. Revista de Economía del Rosario, 8, 25-58.

Junguito, R. & Rincón, H. (2004). La política fiscal en el siglo XX en Colombia. Bogotá, Colombia: Banco de la República.

Keynes, J. M. (1936). Teoría general de la ocupación, el interés y el dinero. México, D. F., México: Fondo de Cultura Económica.

Kneller, R.; Bleaney, M. & Gemmell, N. (1999). Fiscal policy and growth: evidence from OECD countries. Journal of Public Economics, 74, 171-190.

Lee, Y. & Gordon, R. (2005). Tax structure and economic growth. Journal of Public Economics, 89, 1027-1043.

Murphy, R. (2005). Fiscal paradise or tax on development? Tax Justice Network.

Murphy, R. et al. (2007). Closing the Floodgates: Collecting tax to pay for development. Tax Justice Network.

Organización de las Naciones Unidas, ONU (2000). Asamblea General.

Murphy, R. et al. (2002). Monterrey Consensus on Financing for Development.

Owens, J. & Carey, R. (2009). Tax for Development. OECD.

Owens, J. & Carey, R. (2009). Why tax matters for development. OECD.

Releasing the Hidden Billions for Poverty Eradication (2000). Oxfam.

Ricardo, D. (1817). Principios de economía política y tributación. México, D. F., México: Fondo de Cultura Económica.

Rodden, J. (2004). Comparative Federalism and Decentralization: On Meaning and Measurement. Comparative Politics, 36, 481-500.

Ross, M. (2004). Does taxation lead to representation? British Journal of Political Science, 34, 229-249.

Sachs, J. D. (2005). El fin de la pobreza. Penguin.

Smith, A. (1776). Investigación sobre la naturaleza y causas de la riqueza de las naciones. México, D. F., México: Fondo de Cultura Económica.

Tax Haven Abuses: The Enablers, The Tooks and Secrecy (2006). EE. UU.: United States Senate.

Taxes and Economic Development (2010). Institute on Taxation and Economic Policy.

Transparency International (2011). Corruption Perceptions Index 2010.

Uribe, M. C. (2006). El impuesto predial en los municipios colombianos: base imponible y cuestiones institucionales. Lincoln Institute of Land Policy.

Wooldridge, J. M. (2008). Econometric Analysis of Cross Section and Panel Data, vol. 1, 2.a ed. Londres, RU: The MIT Press.