Business Cycle and Risk Premium in the Colombian Stock Market

Main Article Content

Keywords

Business cycle, Consumption, GDP, Unemployment rate, Risk premium

Abstract

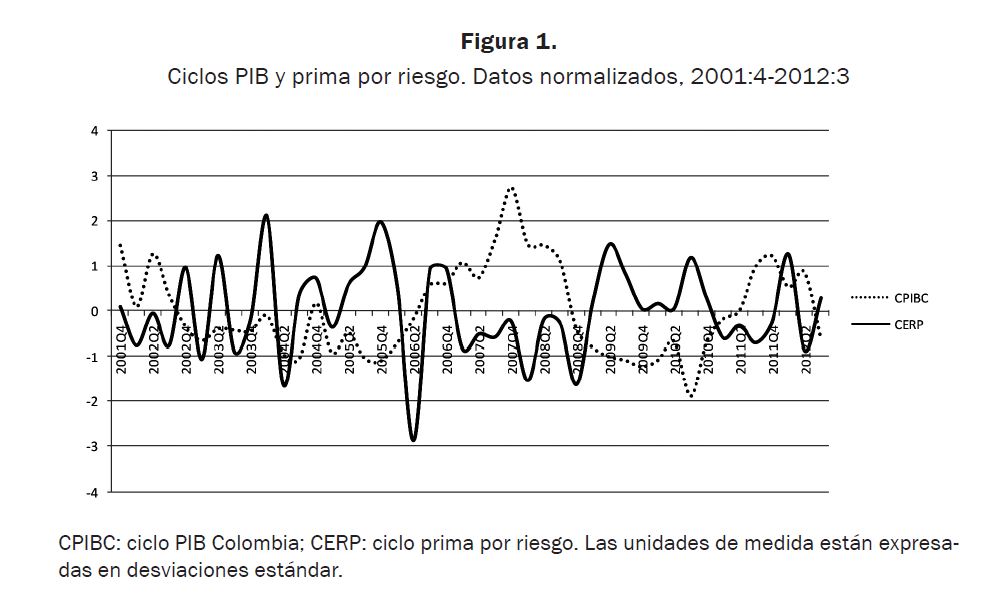

Through the Hodrick-Prescott methodology this paper presents a review about the relationship between the ex post risk premium of the stock market and business cycles observed in Colombia. Through quarterly information from the fourth quarter of 2001 to the third quarter of 2012, statistical evidence shows that the increase and decrease of ex post risk premium follow a countercyclical behavior in tune with existing research conducted about the United States and emerging economies, although with non-contemporary relationships with private consumption. In addition, it is found that in the last decade the Colombian risk premium follows a process of Auto Regressive Moving Average Models (ARMA), showing that there is no variation in at least two consecutive quarters and whose behavior is generated in part by external events at the domestic economic activity level experienced in near past periods.

Downloads

Download data is not yet available.

References

Damodaran, A. (2008). What is the Riskfree Rate? A Search for the Basic Building Block. Recuperado de la base de datos SSRN: http://dx.doi.org/10.2139/ssrn.1317436

Damodaran, A. (2012). Equity Risk Premiums (ERP): Determinants, Estimation and Implications – The 2012 Edition. Recuperado de la base de datos SSRN: http://dx.doi. org/10.2139/ssrn.2027211

Fama, E. French, K. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25(1), 23-49. Recuperado de la base de datos Science Direct.

Fama (2004). The Capital Asset Pricing Model: Theory and Evidence. Journal of Economic Perspectives, 18(3), 25-46. Recuperado de la base de datos JSTOR

Fernández, P. (2009). Prima de riesgo del mercado: histórica, esperada, exigida e implícita. Universia Business Review, 21, 56-65. Recuperado de http://ubr.universia.net/ pdfs_web/UBR001200956.pdf

Fernández, P. (2009). The Equity Premium in 100 Textbooks. Recuperado de la base de datos SSRN: http://dx.doi.org/10.2139/ssrn.1148373

Ferson, E. y Harvey, C. (1991). The variation of economic risk premiums. Journal of Political Economy, 99(2), 385-415. Recuperado de la base de datos JSTOR

García, C. y Moreno, J. (2011). Optimización de portafolios de pensiones en Colombia: el esquema de multifondos, 2003-2010. Ecos de Economía, 15(33), 139-183. Recuperado de: http://publicaciones.eafit.edu.co/index.php/ecos-economia/article/view/ 482/447

Hess, G. e Iwata, S. (1997). Measuring and Comparing Business – Cycle Features. Journal of Business and Economic Statistics, 15(4), 432-444. Recuperado de la base de datos JSTOR.

Hodrick, R. y Prescott, E. (1997). Postwar U.S. business cycles: an empirical investigation. Journal of Money, Credit and Banking, 29(1), 1-16. Recuperado de la base de datos JSTOR.

Ibbotson, R. G. y Goetzmann, W. N. (2005). History and the Equity Risk Premium. Yale ICF Working Paper No. 05-04. Recuperado de la base de datos SSRN: http://ssrn. com/abstract=702341

Jara, D. (2006). Propuestas dirigidas a mejorar la eficiencia de los fondos de pensiones. Borradores de Economía, 423, 1-14. Recuperado de http://www.banrep.gov.co/cgi-bin/ borradores/busqueda.pl

Kuznets, S. (1930). Equilibrium Economics and Business - Cycle Theory. The Quarterly Journal of Economics, 44(1), 381-415. Recuperado de la base de datos JSTOR.

Lettau, M.; Ludvigson, S. y Wachter, J. (2008). The Declining Equity Risk Premium: What role does macroeconomic risk play? Review of Financial Studies, 21(4), 1653-1687. Recuperado de la base de datos JSTOR

Lucas, R. (1978). Asset Prices in an Exchange Economy. Econometrica, 46(6), 1429-1445. Recuperado de la base de datos JSTOR

Lustig, H. y Verdelhan, A. (2012). Business cycle variation in the risk – return trade off. Journal of Monetary Economics, 59, 535-549. Recuperado de la base de datos ScienceDirect

Martínez, O. y Murcia, A. (2007). Desempeño financiero de los fondos de pensiones obligatorias en Colombia. Reporte de Estabilidad Financiera, 75-90. Recuperado de http://www.banrep.gov.co/publicaciones/pub_es_fin.htm#2007

Markowitz, H. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91. Recuperado de la base de datos JSTOR

Mehra, R. (2003). The equity premium: Why is it a puzzle? Financial Analysts Journal, 59(1), 54-69. Recuperado de la base de datos JSTOR

Mill, J. S. (1848). Principles of Political Economy with some of their Applications to Social Philosophy. Recuperado de: http://www.econlib.org/library/Mill/mlP.html

Salomons, R. y Grootveld, H. (2003). The equity risk premium: emerging vs. developed markets. Emerging Markets Review, 4(2), 121-144. Recuperado de la base de datos ScienceDirect.

Damodaran, A. (2012). Equity Risk Premiums (ERP): Determinants, Estimation and Implications – The 2012 Edition. Recuperado de la base de datos SSRN: http://dx.doi. org/10.2139/ssrn.2027211

Fama, E. French, K. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25(1), 23-49. Recuperado de la base de datos Science Direct.

Fama (2004). The Capital Asset Pricing Model: Theory and Evidence. Journal of Economic Perspectives, 18(3), 25-46. Recuperado de la base de datos JSTOR

Fernández, P. (2009). Prima de riesgo del mercado: histórica, esperada, exigida e implícita. Universia Business Review, 21, 56-65. Recuperado de http://ubr.universia.net/ pdfs_web/UBR001200956.pdf

Fernández, P. (2009). The Equity Premium in 100 Textbooks. Recuperado de la base de datos SSRN: http://dx.doi.org/10.2139/ssrn.1148373

Ferson, E. y Harvey, C. (1991). The variation of economic risk premiums. Journal of Political Economy, 99(2), 385-415. Recuperado de la base de datos JSTOR

García, C. y Moreno, J. (2011). Optimización de portafolios de pensiones en Colombia: el esquema de multifondos, 2003-2010. Ecos de Economía, 15(33), 139-183. Recuperado de: http://publicaciones.eafit.edu.co/index.php/ecos-economia/article/view/ 482/447

Hess, G. e Iwata, S. (1997). Measuring and Comparing Business – Cycle Features. Journal of Business and Economic Statistics, 15(4), 432-444. Recuperado de la base de datos JSTOR.

Hodrick, R. y Prescott, E. (1997). Postwar U.S. business cycles: an empirical investigation. Journal of Money, Credit and Banking, 29(1), 1-16. Recuperado de la base de datos JSTOR.

Ibbotson, R. G. y Goetzmann, W. N. (2005). History and the Equity Risk Premium. Yale ICF Working Paper No. 05-04. Recuperado de la base de datos SSRN: http://ssrn. com/abstract=702341

Jara, D. (2006). Propuestas dirigidas a mejorar la eficiencia de los fondos de pensiones. Borradores de Economía, 423, 1-14. Recuperado de http://www.banrep.gov.co/cgi-bin/ borradores/busqueda.pl

Kuznets, S. (1930). Equilibrium Economics and Business - Cycle Theory. The Quarterly Journal of Economics, 44(1), 381-415. Recuperado de la base de datos JSTOR.

Lettau, M.; Ludvigson, S. y Wachter, J. (2008). The Declining Equity Risk Premium: What role does macroeconomic risk play? Review of Financial Studies, 21(4), 1653-1687. Recuperado de la base de datos JSTOR

Lucas, R. (1978). Asset Prices in an Exchange Economy. Econometrica, 46(6), 1429-1445. Recuperado de la base de datos JSTOR

Lustig, H. y Verdelhan, A. (2012). Business cycle variation in the risk – return trade off. Journal of Monetary Economics, 59, 535-549. Recuperado de la base de datos ScienceDirect

Martínez, O. y Murcia, A. (2007). Desempeño financiero de los fondos de pensiones obligatorias en Colombia. Reporte de Estabilidad Financiera, 75-90. Recuperado de http://www.banrep.gov.co/publicaciones/pub_es_fin.htm#2007

Markowitz, H. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91. Recuperado de la base de datos JSTOR

Mehra, R. (2003). The equity premium: Why is it a puzzle? Financial Analysts Journal, 59(1), 54-69. Recuperado de la base de datos JSTOR

Mill, J. S. (1848). Principles of Political Economy with some of their Applications to Social Philosophy. Recuperado de: http://www.econlib.org/library/Mill/mlP.html

Salomons, R. y Grootveld, H. (2003). The equity risk premium: emerging vs. developed markets. Emerging Markets Review, 4(2), 121-144. Recuperado de la base de datos ScienceDirect.