Real options as an alternative methodology to assess investment projects

Main Article Content

Keywords

Real Options, Financial Options, Binomial Trees.

Abstract

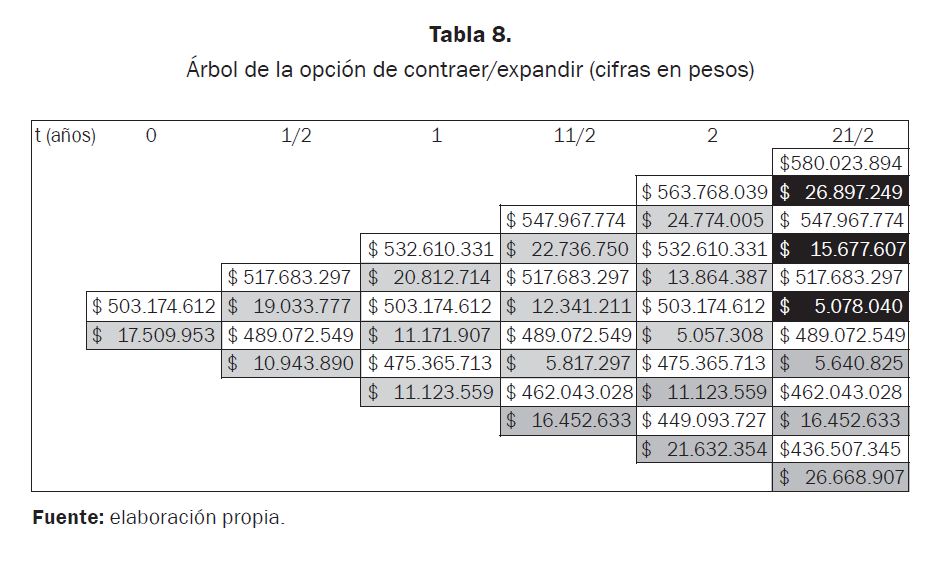

This paper aims to broaden the applicability of the assessment methodology of investment projects through real options as a key element for investment decision making. Traditional project valuation methodologies are described and their gaps, which special characteristic is uncertainty, are presented. A parallel between financial and real options that could be used for valuation is made, using the binomial tree method. Finally, a case study in the construction sector shows a project valuation using expand and waiting options.

Downloads

References

BRENNAN, M. J. & SCHWARTZ, E. S. (1985). Evaluating Natural Resource Investments. Journal of Business, 58(2), 135-157.

COPELAND, T. (2003). Real Options: A Practitioner´s Guide. Nueva York, NY: Texere.

COPELAND, T. E. & KEENAN, P. T. (1998). Making Real Options Real. McKinsey Quarterly (3), 128-141.

COX, J. C., ROSS, S. A. & RUBINSTEIN, M. (1979). Option Pricing: A Simplified Approach. Journal of Financial Economics, 7(3), 229-263.

DIXIT, A. K. (1994). Invesment Under Uncertainty. New Jersey, NJ: Princeton University Press.

GÓMEZ, C. A. (2004). Un caso de estudio para evaluar alternativas de inversión usando opciones reales. Tesis de Maestría no publicada. Universidad de Puerto Rico, Puerto Rico.

JOHN, R. G. & Campbell, R. H. (2001). The Theory and Practice of Corporate Finance: Evidence from the Field. Journal of Financial Economics, 60, 187-243. doi: 10.1016/s0304-405x(01)00044-7

KESTER, W. C. (1984). Today's Options for Tomorrow's Growth' (pp. 153-160).

LÓPEZ, F. (2001, marzo-abril). Trampas en la valoración de negocios. España: Harvard Deusto Bussiness Review.

MAJD, S. (1987). Time to Build, Option Value and Investment Decisions. Journal of Financial Economics, 18.

MASCAREÑAS, J. (1999). Innovación financiera: Aplicaciones para la gestión empresarial. Madrid, España: McGraw-Hill.

MASCAREÑAS, J. (2004). Opciones reales y valoración de activos. Madrid: Pearson.

MYERS, S. C. (1984). Finance Theory and Financial Strategy. Interfaces, 14(1), 126-137.

QUIGG, L. (1993). Empirical Testing of Real Option-Pricing Models. Journal of Finance, 48(2), 621-640.

ROSS, S. (2000). Fundamentos de finanzas corporativas, 5a. ed. Madrid, España: McGraw-Hill.

TITMAN, S. (1985). Urban Land Prices under Uncertainty. American Economic Review, 75(3), 505.

TRIGEORGIS, L. (1995). Real Options: An Overview. Real Options in Capital Investment: Models, Strategies and Applications B2. Westport, U. S.: Praeger.

WILLIAMS, J. T. (1991). Real Estate Development as an Option. Journal of Real Estate Finance & Economics, 4(2), 191-208.