Sources of Economic Fluctuations in Central America

Main Article Content

Keywords

Economic Fluctuations, SVAR Models, Panel Data

Abstract

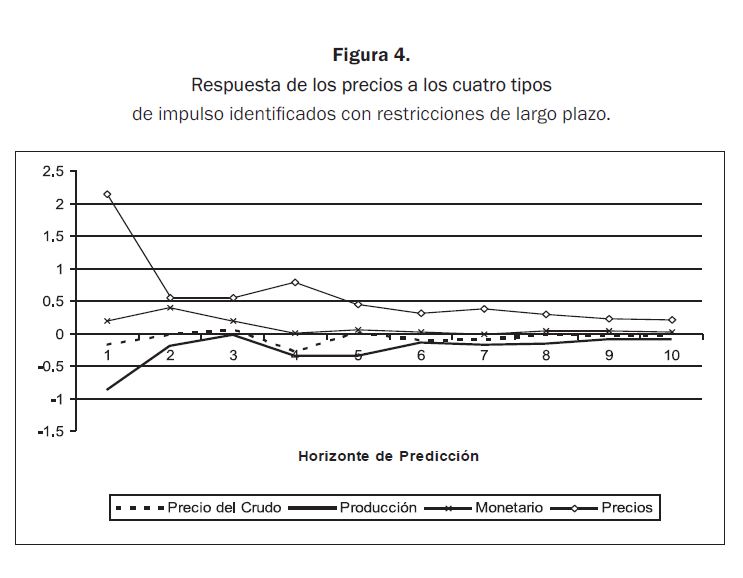

Using panel data from Central America, this paper studies the determining factors of inflation and aggregate output fluctuations by estimating two Structural Vector Autoregressive (SVAR) models. Price and output variables are included in one of the models, whereas M2 and the price of oil are additional variables in the other one. Findings of this study suggest that price is determined by the demand, while output seems to be influenced mainly by the supply shocks in that area. It was also evidenced that the price of oil does not have a significant impact on the general price level in that region.

Downloads

Download data is not yet available.

References

Ahmed S. L. y Park, J. H. (1992). Sources of Macroeconomic Fluctuations in Small Open Economies. Working Paper núms. 92-22, Federal Reserve Bank of Philadelphia.

Andrews, D. W. K. (1993). Test for Parameter Instability and Structural Change with Unknown Change Point. Econometrica, 6(4), 821-56.

Arellano, M. y Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies, 58, 277-97.

Arellano, M. y Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29-51.

Artana, D.; Catena, M. y Navajas, F. (2007). El shock de los precios del petróleo en América Central: implicancias fiscales y energéticas. Documento de Trabajo núm. 624, Banco Interamericano de Desarrollo (BID), Departamento de Investigación.

Bashar O., H. M. N. (2011). On the permanent effect of an aggregate demand shock: Evidence from the G-7 countries. School of Accounting, Economics and Finance, Deakin University. Australia Economic Modelling 28, 1374-82.

Batten, D. S. (junio-julio de 1981). Inflation: The Cost-Push Myth. Federal Reserve Bank of St. Louis Review, 20-6.

Beck, N. y Katz, J. N. (2007). Random Coefficient Models for Time-Series–Cross-Section Data: Monte Carlo Experiments. Political Analysis, 15, 182-90.

Blanchard, O. (1989). A Traditional Interpretation of Macroeconomic Fluctuations. The American Economic Review, 79(5), 1146-64.

Blanchard O. y Quah, D. (1989). The Dynamic Effects of Aggregate Demand and Supply Disturbances. The American Economic Review, 79(4), 655-73.

Holtz-Eakin, D.; Newey, W. y Rosen, H. S. (1988). Estimating Vector Autoregressions with Panel Data. Econometrica, 56(6), 1371-95.

Humphrey, T. M. (verano de 1998). Historical Origins of the Cost-Push Fallacy. Federal Reserve Bank of Richmond Economic Quarterly, 53-74.

Iraheta, M.; Medina, M. y Blanco, C. (2008). Impacto del incremento de los precios del petróleo y los combustibles en la inflación de Centroamérica y República Dominicana. Documento de Trabajo SECMCA I – 2408, Consejo Monetario Centroamericano.

Judson, R. A. y Owen, A. L. (1999). Estimating Dynamic Panel Data Models: A Practical Guide for Macroeconomists. Economic Letters, 65, 9-15.

Karras, G. (1993). Sources of U.S. Macroeconomic Fluctuations: 1973-1989. Journal of Macroeconomics, 15(1), 47-68.

Keating, J. W. y Nye, J. V. (1998). Permanent and Transitory Socks in Real Output: Estimates from Nineteenth – Century and Postwar Economies. Journal of Money Credit and Banking, 30(1), 231-51.

Kydland, F. E. y Prescott, E. C. (1982). Time to Build and Aggregate Fluctuations. Econometrica, 50(6), 345-70.

Lucas, R. E. Jr. (1972). Expectations and the Neutrality of Money. Journal of Economic Theory, 4(2), 103-124.

McCandless, G. T. y Weber, W. E. (verano de 1995). Some Monetary Facts. Federal Reserve Bank of Minneapolis Quarterly Review, 2-11.

Mio, H. (enero de 2002). Identifying Aggregate Demand and Aggregate Supply Components of Inflation Rate: A Structural Vector Autoregression Analysis for Japan. Monetary And Economic Studies, 33-56.

Parsley, D. C. (1996). Inflation and Relative Price Variability in the Short and Long Run: New Evidence from United States. Journal of Money Credit and Banking 28(3), 323-41.

Quandt, R. (1960). Test of the Hypothesis that a Linear Regression Obeys Two Separate Regimes. Journal of the American Statistical Association, 55, 324-30.

Shapiro, M. y Watson, M. (1988). Sources of Business Cycle Fluctuations. National Bureau of Economic Research Macroeconomics Annuals, 111-48.

Andrews, D. W. K. (1993). Test for Parameter Instability and Structural Change with Unknown Change Point. Econometrica, 6(4), 821-56.

Arellano, M. y Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies, 58, 277-97.

Arellano, M. y Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29-51.

Artana, D.; Catena, M. y Navajas, F. (2007). El shock de los precios del petróleo en América Central: implicancias fiscales y energéticas. Documento de Trabajo núm. 624, Banco Interamericano de Desarrollo (BID), Departamento de Investigación.

Bashar O., H. M. N. (2011). On the permanent effect of an aggregate demand shock: Evidence from the G-7 countries. School of Accounting, Economics and Finance, Deakin University. Australia Economic Modelling 28, 1374-82.

Batten, D. S. (junio-julio de 1981). Inflation: The Cost-Push Myth. Federal Reserve Bank of St. Louis Review, 20-6.

Beck, N. y Katz, J. N. (2007). Random Coefficient Models for Time-Series–Cross-Section Data: Monte Carlo Experiments. Political Analysis, 15, 182-90.

Blanchard, O. (1989). A Traditional Interpretation of Macroeconomic Fluctuations. The American Economic Review, 79(5), 1146-64.

Blanchard O. y Quah, D. (1989). The Dynamic Effects of Aggregate Demand and Supply Disturbances. The American Economic Review, 79(4), 655-73.

Holtz-Eakin, D.; Newey, W. y Rosen, H. S. (1988). Estimating Vector Autoregressions with Panel Data. Econometrica, 56(6), 1371-95.

Humphrey, T. M. (verano de 1998). Historical Origins of the Cost-Push Fallacy. Federal Reserve Bank of Richmond Economic Quarterly, 53-74.

Iraheta, M.; Medina, M. y Blanco, C. (2008). Impacto del incremento de los precios del petróleo y los combustibles en la inflación de Centroamérica y República Dominicana. Documento de Trabajo SECMCA I – 2408, Consejo Monetario Centroamericano.

Judson, R. A. y Owen, A. L. (1999). Estimating Dynamic Panel Data Models: A Practical Guide for Macroeconomists. Economic Letters, 65, 9-15.

Karras, G. (1993). Sources of U.S. Macroeconomic Fluctuations: 1973-1989. Journal of Macroeconomics, 15(1), 47-68.

Keating, J. W. y Nye, J. V. (1998). Permanent and Transitory Socks in Real Output: Estimates from Nineteenth – Century and Postwar Economies. Journal of Money Credit and Banking, 30(1), 231-51.

Kydland, F. E. y Prescott, E. C. (1982). Time to Build and Aggregate Fluctuations. Econometrica, 50(6), 345-70.

Lucas, R. E. Jr. (1972). Expectations and the Neutrality of Money. Journal of Economic Theory, 4(2), 103-124.

McCandless, G. T. y Weber, W. E. (verano de 1995). Some Monetary Facts. Federal Reserve Bank of Minneapolis Quarterly Review, 2-11.

Mio, H. (enero de 2002). Identifying Aggregate Demand and Aggregate Supply Components of Inflation Rate: A Structural Vector Autoregression Analysis for Japan. Monetary And Economic Studies, 33-56.

Parsley, D. C. (1996). Inflation and Relative Price Variability in the Short and Long Run: New Evidence from United States. Journal of Money Credit and Banking 28(3), 323-41.

Quandt, R. (1960). Test of the Hypothesis that a Linear Regression Obeys Two Separate Regimes. Journal of the American Statistical Association, 55, 324-30.

Shapiro, M. y Watson, M. (1988). Sources of Business Cycle Fluctuations. National Bureau of Economic Research Macroeconomics Annuals, 111-48.