Métodos para predecir índices Bursátiles

Main Article Content

Keywords

Bolsa de Valores, índice, Pronósticos

Resumen

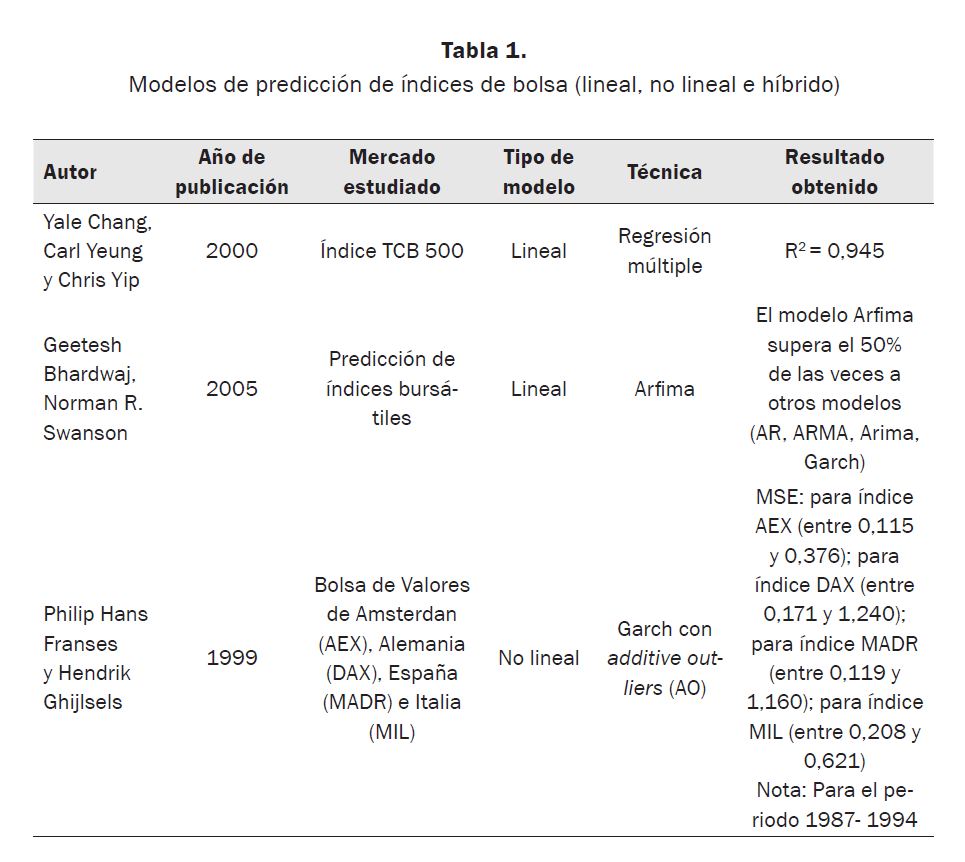

Este artículo presenta una revisión bibliográfica acerca de los métodos que se han utilizado en las últimas dos décadas para predecir Índices Bursátiles. Los métodos estudiados van desde aquellos que logran capturar las características lineales presentes en los índices de bolsa, pasando por los que se enfocan en las características no lineales y finalmente métodos híbridos que son más robustos, pues capturan características lineales y no lineales. Además, se incluyen aquellos métodos que utilizan variables macroeconómicas para predecir los índices de diferentes Bolsas de Valores en el mundo.

Descargas

Los datos de descargas todavía no están disponibles.

Referencias

Komo, D.; Chang, C.-I. y KO, H. (1994). Neural Network Technology For Stock Market Index Prediction. International Symposium on Speech, Image Processing and Neural Networks (pp. 543-546). Hong Kong: IEEE.

Lasfer , M.; Melnik , A. y Thomas, D. (2003). Short-term reaction of stock markets in stressful circumstances. Journal of Banking & Finance, 1959-77.

Liu, H.-C. y Hung, J.-C. (2010). Forecasting S&P-100 stock index volatility: The role of volatility asymmetry and distributional assumption in Garch models. Expert Systems with Applications, 4928-34.

Zemke, S. (1999). Nonlinearindexprediction. Physica A: Statistical Mechanics and its Applications , 177-83.

Aboueldahab, T. y Fakhreldin, M. (2011). Prediction of Stock Market Indices using Hybrid Genetic Algorithm/ Particle Swarm Optimization with Perturbation Term. International Conference on swarm intelligence. Cergy, France.

Alonso, J. y Garcia, J. (2009). ¿Qué tan buenos son los patrones del IGBC para predecir su comportamiento? Universidad Icesi, 13-36.

Asadi, S.; Hadavandi, E.; Mehmanpazir, F. y Nakhostin, M. (2012). Hybridization of evolutionary Levenberg–Marquardt neural networks and data pre-processing for stock market prediction. Knowledge-Based Systems, 245-58.

Bhardwaj, G. y Swanson, N. (2006). An empirical investigation of the usefulness of Arfima models for predicting macroeconomic and financial time series. Journal of Econometrics, 539-78.

Boyacioglu, M. A. y Avci, D. (2010). An Adaptive Network-Based Fuzzy Inference System (ANFIS) for the prediction of stock market return: The case of the Istanbul Stock Exchange. Expert Systems with Applications, 7908-12.

Cai , Y.; Chou, R. y Li , D. (2009). Explaining international stock correlations with CPI fluctuations and market volatility. Journal of Banking & Finance, 2026-35.

Caldas Montes, G. y Pires Tiberto, B. (2012). Macroeconomic Environment, country risk and stock market performance: Evidence for Brazil. Elsevier Science, 1666-78.

Chaigusin, S.; Chirathamjaree, C. y Clayden, J. (2008). The Use of Neural Networks in the Prediction of the Stock Exchange of Thailand (SET) index. Computational Intelligence for Modelling Control & Automation. IEEE.

Chang, Y.; Yeung, C. y Yip, C. (2000). Analysis of the influence of economic indicators on stock prices using multiple regression.

Chen, A.-S.; Leung, M. y Daouk, H. (2003). Application of neural networks to an emerging financial market: forecasting and trading the Taiwan Stock Index. Computers & Operations Research, 901-23.

Chen, S.-S. (2009). Predicting the bear stock market: Macroeconomic variables as leading indicators. Journal of Banking & Finance, 211-23.

Cheng , C.-H.; Chen , T.-L. y Wei, L.-Y. (2010). A hybrid model based on rough sets theory and genetic algorithms for stock price forecasting. Information Sciences, 1610-29.

Clements, M.; Franses, P. y Swanson, N. (2004). Forecasting economic and financial time-series with non-linear models. International Journal of Forecasting, 169-83.

Dai, W.; Wu, J.-Y. y Lu, C.-J. (2012). Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Systems with Applications, 4444-52.

Domínguez Gijón, R. y Zambrano Reyes, A. (2011). Pronóstico con modelos Arima para los casos del índice de precios y cotizaciones (IPC) y la Acción de América Móvil (AM). Memoria del XXI Coloquio Mexicano de Economía Matemática y Econometría.

El-Henawy, I.; Kamal, A.; Abdelbary, H. y Abas, A. (2010). Predicting Stock Index Using Neural Network Combined with Evolutionary Computation Methods. IEEE, 1-6.

Enke, D.; Grauer, M. y Mehdiyev, N. (2011). Stock Market Prediction with Multiple Regression, Fuzzy Type-2 Clustering and Neural Networks. Procedia Computer Science, 201-06.

Franses, P. y Ghijsels, H. (1999). Additive outliers, GARCH and forecasting volatility. International Journal of Forecasting, 1-9.

Gençtürk, M.; Çelik, I. y Binici, Ö. (2012). Causal relations among stock returns and macroeconomic variables in a small and open economy. African Journal of Business Management, 6177-82.

Gjerde, Ø. y Sættem, F. (1999). Causal relations among stock returns and macroeconomic. Journal of International Financial Market, 61-74.

Guresen, E.; Kayakutlu, G. y Daim, T. (2011). Using artificial neural network models in stock market index prediction. Expert Systems with Applications, 10389-97.

Hadavandi, E.; Shavandi, H. y Ghanbari, A. (2010). Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowledge-Based Systems, 800-08.

Kim, K.-j. y Han, I. (2000). Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert Systems with Applications, 125-32.

Kwon, C. y Shin, T. (1998). Cointegration and causality between macroeconomic variables and stock market returns. Global Finance Journal, 71-81.

Lee, K. y Jo, G. (1999). Expert system for predicting stock market timing using a candlestick chart. Expert Systems with Applications, 357-64.

López Herrera, F. y Vásquez Téllez, F. (2002). Variables macroeconómicas y un modelo multifactorial para la Bolsa Mexicana de Valores: análisis empírico sobre una muestra de activos. Academia. Revista Latinoamericana de investigacion , 5-28.

Lu, C.-J.; Chang, C.-H.; Chen, C.-Y.; Chiu, C.-C. y Lee, T.-S. (2009). Stock Index Prediction: A Comparison of MARS, BPN and SVR in an Emerging Market. Industrial Engineering and Engineering Management. IEEE.

Majhi, R.; Panda, G.; Majhi, B. y Sahoo, G. (2009). Efficient prediction of stock market indices using adaptive bacterial foraging optimization (ABFO) and BFO based techniques. Expert Systems with Applications, Elsevier, 10097-104.

Maysami, Howe y Hamzah (2004). Relationship between Macroeconomic Variables and Stock Market Indices: Cointegration Evidence from Stock Exchange of Singapore’s All-S Sector Indices. Journal Pengurusan, 47-77.

Pai, P.-F. y Lin, C.-S. (2005). A hybrid Arima and support vector machines model in stock price forecasting. Omega, Elsevier, 497-505.

Parisi, A.; Parisi, F. y Díaz, D. (2006). Modelos de algoritmo genético y redes neuronales en la predicción de índices bursátiles asiáticos. Cuadernos de economía, 251-84.

Pierdzioch, C.; Dopke, J. y Hartmann, D. (2008). “Forecasting stock market volatility with macroeconomic variables in real time”. Journal of Economics and Business, 256-76.

Reddy, B. (2010). Prediction of Stock Market Indices – Using SAS. IEEE.

Roh, T. (2007). Forecasting the volatility of stock price index. Expert Systems with Applications, 916-22.

Shen, W.; Guo, X.; Wub, C. y Wu, D. (2011). Forecasting stock indices using radial basis function neural networks optimized by artificial fish swarm algorithm. Knowledge-Based Systems, 378-85.

Toro Ocampo, E. M.; Molina Cabrera, A. y Garcés Ruiz, A. (2006). Pronóstico de bolsa de valores empleando técnicas inteligentes. Tecnura.

Wang , J.-Z.; Wang, J.-J.; Zhang, Z.-G. y Guo, S.-P. (2011). Forecasting stock indices with back propagation neural network. Expert Systems with Applications, 14346-55.

Wang, J.-J.; Wang, J.-Z.; Zhang, Z.-G. y Guo, S.-P. (2012). Stock index forecasting based on a hybrid model. Omega, 758-66.

Wang, Y.-F.; Cheng, S. y Hsu, M.-H. (2010). Incorporating the Markov chain concept into fuzzy stochastic prediction of stock indexes. Applied Soft Computing, 613-17.

Yu, T.-K. y Huarng, K.-H. (2010). A neural network-based fuzzy time series model to improve forecasting. Expert Systems with Applications, 3366-72.

Yudong , Z. y Lenan, W. (2009). Stock market prediction of S&P 500 via combination of improved BCO approach and BP neural network. Expert Systems with Applications, 8849-54.

Zhu, X.; Xu, L.; Wang, H. y Li, H. (2008). Predicting stock index increments by neural networks: The role of trading volume under different horizons. Expert Systems with Applications, 3043-54.

Lasfer , M.; Melnik , A. y Thomas, D. (2003). Short-term reaction of stock markets in stressful circumstances. Journal of Banking & Finance, 1959-77.

Liu, H.-C. y Hung, J.-C. (2010). Forecasting S&P-100 stock index volatility: The role of volatility asymmetry and distributional assumption in Garch models. Expert Systems with Applications, 4928-34.

Zemke, S. (1999). Nonlinearindexprediction. Physica A: Statistical Mechanics and its Applications , 177-83.

Aboueldahab, T. y Fakhreldin, M. (2011). Prediction of Stock Market Indices using Hybrid Genetic Algorithm/ Particle Swarm Optimization with Perturbation Term. International Conference on swarm intelligence. Cergy, France.

Alonso, J. y Garcia, J. (2009). ¿Qué tan buenos son los patrones del IGBC para predecir su comportamiento? Universidad Icesi, 13-36.

Asadi, S.; Hadavandi, E.; Mehmanpazir, F. y Nakhostin, M. (2012). Hybridization of evolutionary Levenberg–Marquardt neural networks and data pre-processing for stock market prediction. Knowledge-Based Systems, 245-58.

Bhardwaj, G. y Swanson, N. (2006). An empirical investigation of the usefulness of Arfima models for predicting macroeconomic and financial time series. Journal of Econometrics, 539-78.

Boyacioglu, M. A. y Avci, D. (2010). An Adaptive Network-Based Fuzzy Inference System (ANFIS) for the prediction of stock market return: The case of the Istanbul Stock Exchange. Expert Systems with Applications, 7908-12.

Cai , Y.; Chou, R. y Li , D. (2009). Explaining international stock correlations with CPI fluctuations and market volatility. Journal of Banking & Finance, 2026-35.

Caldas Montes, G. y Pires Tiberto, B. (2012). Macroeconomic Environment, country risk and stock market performance: Evidence for Brazil. Elsevier Science, 1666-78.

Chaigusin, S.; Chirathamjaree, C. y Clayden, J. (2008). The Use of Neural Networks in the Prediction of the Stock Exchange of Thailand (SET) index. Computational Intelligence for Modelling Control & Automation. IEEE.

Chang, Y.; Yeung, C. y Yip, C. (2000). Analysis of the influence of economic indicators on stock prices using multiple regression.

Chen, A.-S.; Leung, M. y Daouk, H. (2003). Application of neural networks to an emerging financial market: forecasting and trading the Taiwan Stock Index. Computers & Operations Research, 901-23.

Chen, S.-S. (2009). Predicting the bear stock market: Macroeconomic variables as leading indicators. Journal of Banking & Finance, 211-23.

Cheng , C.-H.; Chen , T.-L. y Wei, L.-Y. (2010). A hybrid model based on rough sets theory and genetic algorithms for stock price forecasting. Information Sciences, 1610-29.

Clements, M.; Franses, P. y Swanson, N. (2004). Forecasting economic and financial time-series with non-linear models. International Journal of Forecasting, 169-83.

Dai, W.; Wu, J.-Y. y Lu, C.-J. (2012). Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Systems with Applications, 4444-52.

Domínguez Gijón, R. y Zambrano Reyes, A. (2011). Pronóstico con modelos Arima para los casos del índice de precios y cotizaciones (IPC) y la Acción de América Móvil (AM). Memoria del XXI Coloquio Mexicano de Economía Matemática y Econometría.

El-Henawy, I.; Kamal, A.; Abdelbary, H. y Abas, A. (2010). Predicting Stock Index Using Neural Network Combined with Evolutionary Computation Methods. IEEE, 1-6.

Enke, D.; Grauer, M. y Mehdiyev, N. (2011). Stock Market Prediction with Multiple Regression, Fuzzy Type-2 Clustering and Neural Networks. Procedia Computer Science, 201-06.

Franses, P. y Ghijsels, H. (1999). Additive outliers, GARCH and forecasting volatility. International Journal of Forecasting, 1-9.

Gençtürk, M.; Çelik, I. y Binici, Ö. (2012). Causal relations among stock returns and macroeconomic variables in a small and open economy. African Journal of Business Management, 6177-82.

Gjerde, Ø. y Sættem, F. (1999). Causal relations among stock returns and macroeconomic. Journal of International Financial Market, 61-74.

Guresen, E.; Kayakutlu, G. y Daim, T. (2011). Using artificial neural network models in stock market index prediction. Expert Systems with Applications, 10389-97.

Hadavandi, E.; Shavandi, H. y Ghanbari, A. (2010). Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowledge-Based Systems, 800-08.

Kim, K.-j. y Han, I. (2000). Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert Systems with Applications, 125-32.

Kwon, C. y Shin, T. (1998). Cointegration and causality between macroeconomic variables and stock market returns. Global Finance Journal, 71-81.

Lee, K. y Jo, G. (1999). Expert system for predicting stock market timing using a candlestick chart. Expert Systems with Applications, 357-64.

López Herrera, F. y Vásquez Téllez, F. (2002). Variables macroeconómicas y un modelo multifactorial para la Bolsa Mexicana de Valores: análisis empírico sobre una muestra de activos. Academia. Revista Latinoamericana de investigacion , 5-28.

Lu, C.-J.; Chang, C.-H.; Chen, C.-Y.; Chiu, C.-C. y Lee, T.-S. (2009). Stock Index Prediction: A Comparison of MARS, BPN and SVR in an Emerging Market. Industrial Engineering and Engineering Management. IEEE.

Majhi, R.; Panda, G.; Majhi, B. y Sahoo, G. (2009). Efficient prediction of stock market indices using adaptive bacterial foraging optimization (ABFO) and BFO based techniques. Expert Systems with Applications, Elsevier, 10097-104.

Maysami, Howe y Hamzah (2004). Relationship between Macroeconomic Variables and Stock Market Indices: Cointegration Evidence from Stock Exchange of Singapore’s All-S Sector Indices. Journal Pengurusan, 47-77.

Pai, P.-F. y Lin, C.-S. (2005). A hybrid Arima and support vector machines model in stock price forecasting. Omega, Elsevier, 497-505.

Parisi, A.; Parisi, F. y Díaz, D. (2006). Modelos de algoritmo genético y redes neuronales en la predicción de índices bursátiles asiáticos. Cuadernos de economía, 251-84.

Pierdzioch, C.; Dopke, J. y Hartmann, D. (2008). “Forecasting stock market volatility with macroeconomic variables in real time”. Journal of Economics and Business, 256-76.

Reddy, B. (2010). Prediction of Stock Market Indices – Using SAS. IEEE.

Roh, T. (2007). Forecasting the volatility of stock price index. Expert Systems with Applications, 916-22.

Shen, W.; Guo, X.; Wub, C. y Wu, D. (2011). Forecasting stock indices using radial basis function neural networks optimized by artificial fish swarm algorithm. Knowledge-Based Systems, 378-85.

Toro Ocampo, E. M.; Molina Cabrera, A. y Garcés Ruiz, A. (2006). Pronóstico de bolsa de valores empleando técnicas inteligentes. Tecnura.

Wang , J.-Z.; Wang, J.-J.; Zhang, Z.-G. y Guo, S.-P. (2011). Forecasting stock indices with back propagation neural network. Expert Systems with Applications, 14346-55.

Wang, J.-J.; Wang, J.-Z.; Zhang, Z.-G. y Guo, S.-P. (2012). Stock index forecasting based on a hybrid model. Omega, 758-66.

Wang, Y.-F.; Cheng, S. y Hsu, M.-H. (2010). Incorporating the Markov chain concept into fuzzy stochastic prediction of stock indexes. Applied Soft Computing, 613-17.

Yu, T.-K. y Huarng, K.-H. (2010). A neural network-based fuzzy time series model to improve forecasting. Expert Systems with Applications, 3366-72.

Yudong , Z. y Lenan, W. (2009). Stock market prediction of S&P 500 via combination of improved BCO approach and BP neural network. Expert Systems with Applications, 8849-54.

Zhu, X.; Xu, L.; Wang, H. y Li, H. (2008). Predicting stock index increments by neural networks: The role of trading volume under different horizons. Expert Systems with Applications, 3043-54.